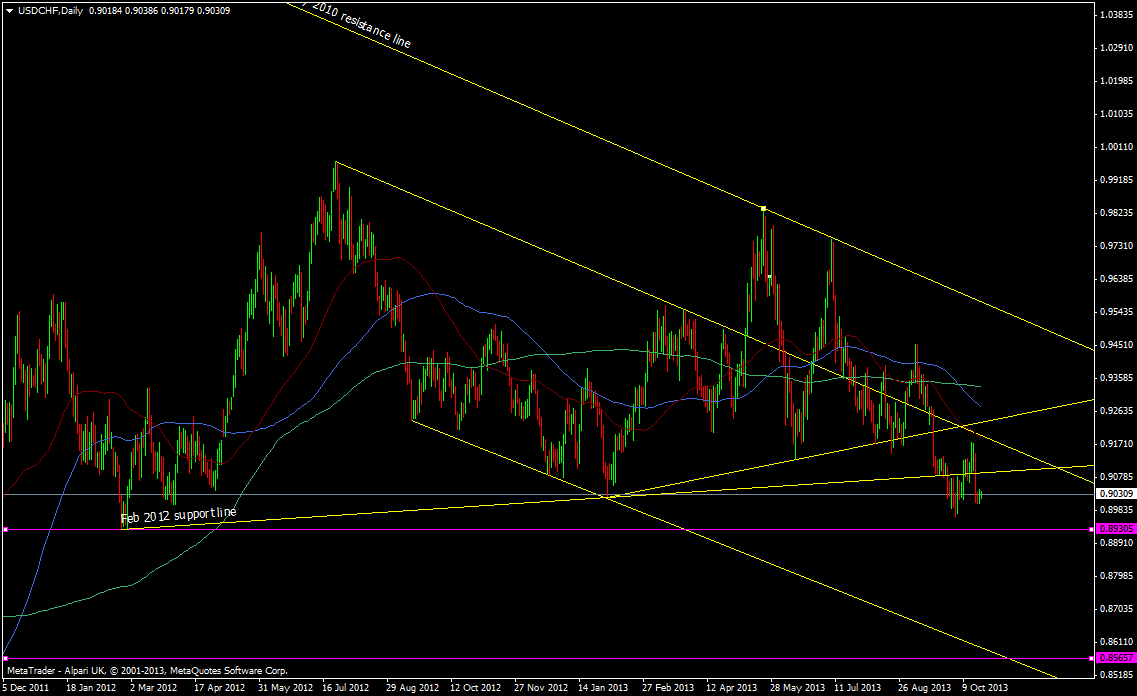

The pair has threatened to break higher on several occasions but has failed to live up to expectations and now the threat of a break lower is on the cards once again.

The broken Feb 2013 low at 0.9020 has mildly acted as a pivot point as has the broken Feb 2012 support line.

USD/CHF daily chart 22 10 2013

Despite the two big spikes this year above 0.9700 and 0.9800 the medium term trend is down.

The Feb 2012 low at 0.8930 is in focus once again and we went as low as 0.8967 back in September. I previously noted that I would like to take a long against that Feb 2012 low and that’s still the case but with the dollar looking decidedly iffy at the moment I would probably keep that fairly tight and would look to reverse the trade on a decent break, with a target of the Oct 2011 low and/or the the lower channel line around 0.8566.

With US data back on the ramp we could finally get some reasons for the dollar to start moving. Today’s NFP could provide a key moment to show what the market thinks of USD. If we get a very good figure I’ll be keeping a very close watch on the price as I get the feeling that a pop higher may well be heavily sold into. If it is then that would suggest that any upside is limited unless we start to string together a run of decent data. Based on the numbers before the shutdown that wasn’t looking likely.

With the market seemingly pushing out the taper into mid 2014 the delayed NFP may not do much to change that view even with a decent number.