Today's CPI data could help keep the Fed on track with further rate hikes

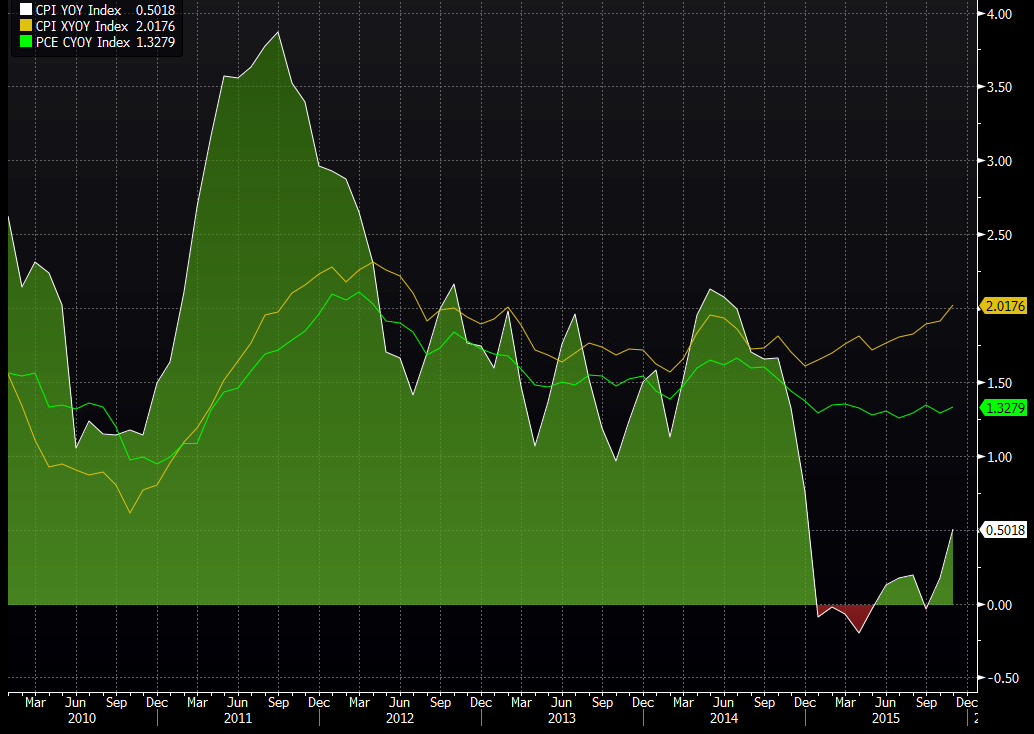

The price picture in the US isn't that bad. Although headline inflation is only running at 0.5%, the core measures on both CPI and PCE tell a better story

US CPI, core & PCE core y/y

Probably the biggest take from inflation both here and across Europe and the UK is that it's not going down anymore. That's a big comfort to central banks and one of the Fed's strongest reasons to maintain the path of interest rate rises. Strip out all the other data noise bar jobs and the Fed's dual mandate is being fulfilled. Sometimes in the thick of the day to day action and the effects it has on our views, the bigger picture tells a calmer story

So today we get to see if that picture continues. CPI is expected to gain to a healthier 0.8% from 0.5% y/y. The core is forecast to add a pip to 2.1%. Matching the prior numbers will still be positive news. Any drops might see Fed future hike naysayers voicing their opinions

As always, I'll be looking at a 2 percentage point margin for price moves. Within a 2 pp change it isn't likely to have a big effect, while 2+ could bring a bigger reaction. The headline expectation is already looking for a +3 pip change so that's quite big an expectation in itself. That could mean that 0.9% or 1.0% print could see the buck rally as that would be a big jump from last month

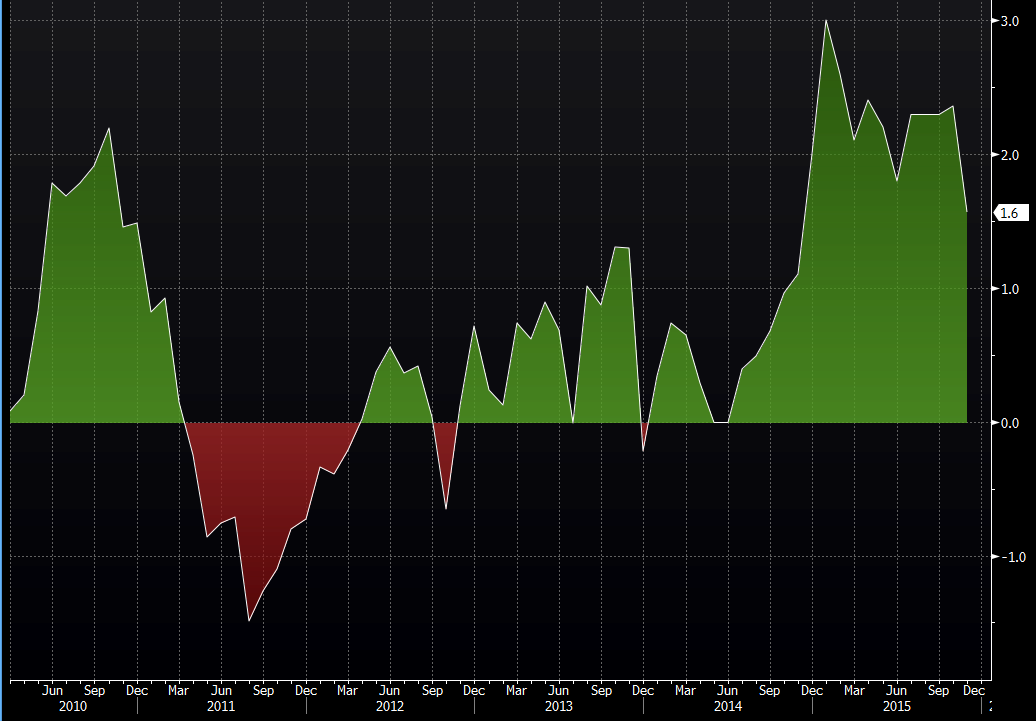

Of course, there's another number in the release that's equally important today and that's the real average weekly earnings. Last month it came in +0.2% m/m and +1.6% y/y. There's no expectations for its release. A good strong number today will be another feather in the hike cap

US real average weekly earnings y/y

All the expectations can be found on our calendar page at the top of your screen