Here's the picture in gold the way I see it.

1) It has declined for seven straight months

That's certainly not a sign of a bull market but nothing falls in a straight line and the decline of 13% is better than many major currencies over that period. The decline is mostly a story of US dollar strength and a tightening Fed.

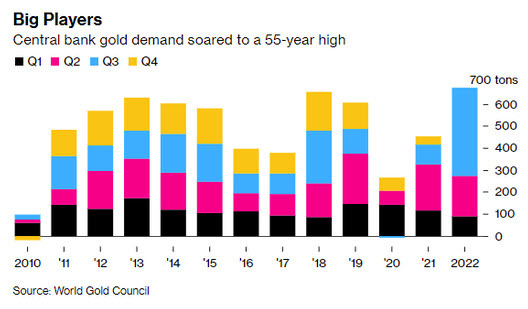

2) Central banks are buying heavily

The World Gold Council reported that central banks bought 399 tons of bullion in the third quarter, which was nearly double the previous record for Q3. It's unclear which central banks were buying but eyes are on Russia and China due to the US's weaponization of the US dollar.

3) Beyond maximum central bank hawkishness

There were 6 major central bank decisions in the past week and 5 of them were dovish. The Fed ratcheted up the terminal rate but only "slightly" as Chicago Fed President Charles Evans said today. To be sure, central banks are still hiking but the pace is slowing and markets generally move on the second derivative.

What worries me is the technicals

The chart isn't great. There's still a daunting double top at $2070 and the latest bounce looks like a retest of the base of it before a further fall. The measured target of the double top is $1350.

What makes me skeptical that it's going to happen is that it hasn't happened yet. It's been a perfect storm of USD strength, central bank hawkishness and a rout in risk assets yet it's held up ok.