Forex futures positioning data among non-commercial traders for the week ending July 16, 2019

- EUR short 31K vs 36K short last week. Shorts trimmed by 5K

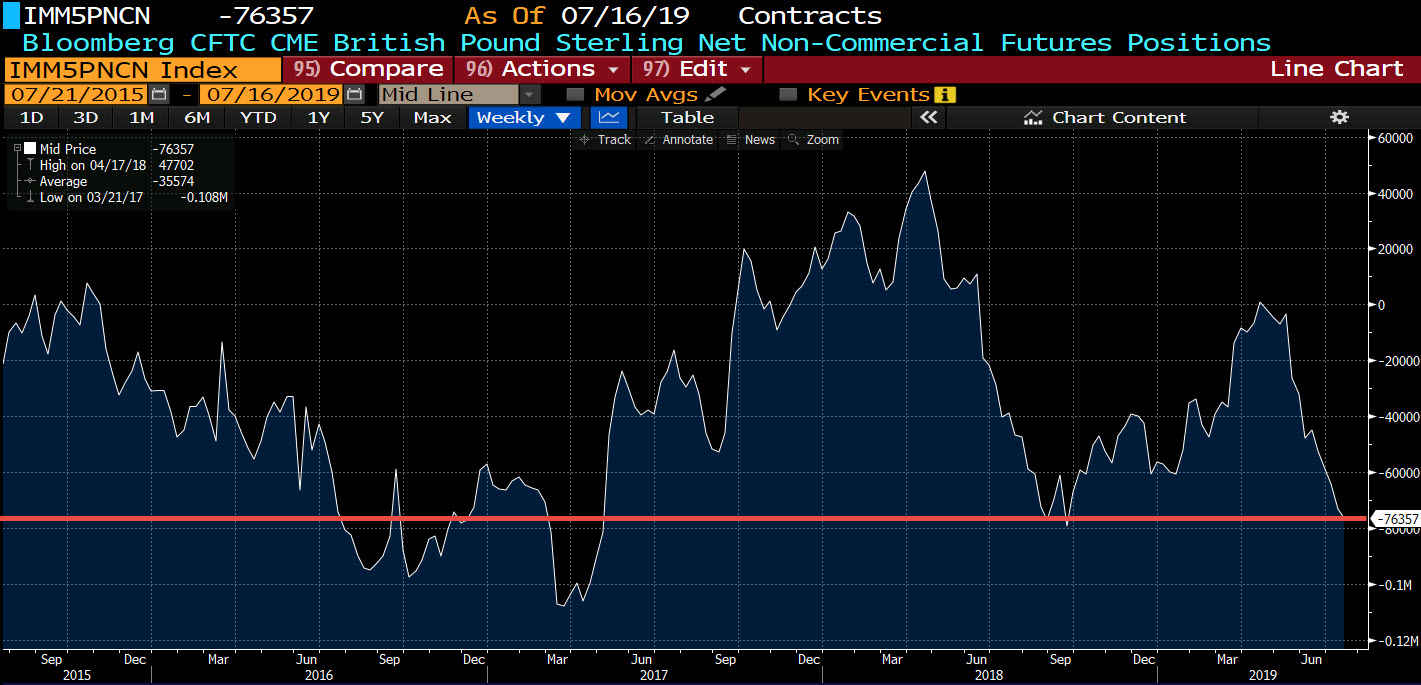

- GBP short 76K vs 73K short last week. Shorts increased by 3K

- JPY short 11K vs 4K short last week. Short increased by 7K

- CHF short 12k vs 10k short last week. Shorts increased by 2K

- AUD short 53k vs 54k short last week. Shorts trimmed by 1K

- NZD short 17K vs 22K short last week. Shorts trimmed by 5K

- CAD long 21K vs 9K long last week. Longs increased by 11K

- Prior week

Highlights:

- GBP shorts remain the largest speculative position. The short is the largest since September 2018

- CAD remains the only long currency position/short USD position. The long position was increased by 12K. That was the largest change of all the major currencies.

- Speculators are long USD (short currencies) vs EUR, GBP, JPY, CHF, AUD, and NZD