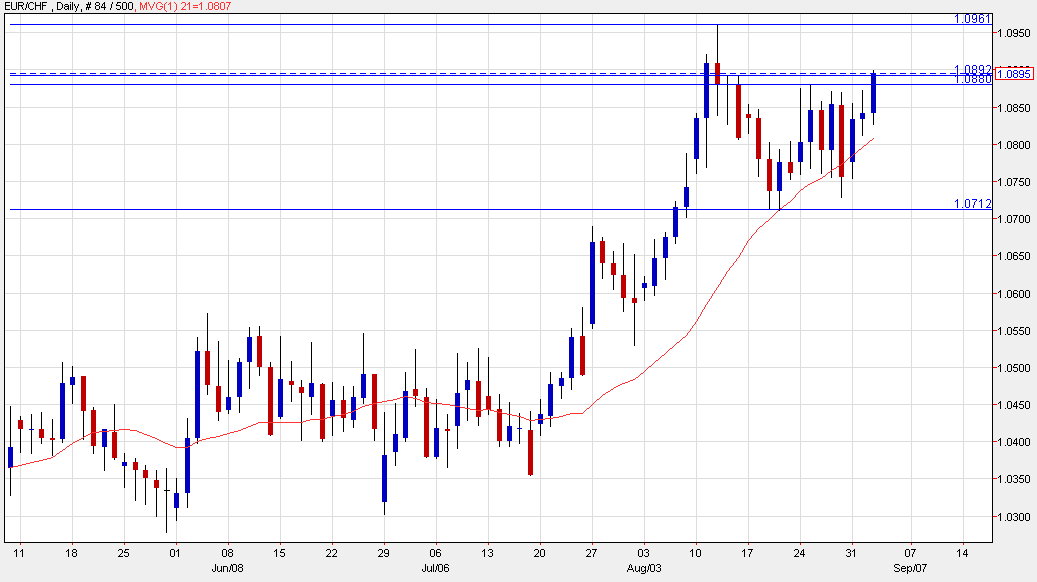

EURCHF technical anlaysis:

Yesterday Swiss National Bank chairman Thomas Jordan warned that his budget for intervention was unlimited and that rates could still be cut.

The headlines didn't have an immediate effect on EUR/CHF as turmoil enveloped markets but today the pair rose to the highest since Aug 11.

Fresh highs in the pair despite turmoil in broader markets is symptomatic of the invisible hand of the SNB.

Techincally, the 1.09 level is containing rallies so far but if it breaks, there is very little resistance until the August high of 1.0961 and the SNB would surely like to see the pair rise.

The problem is that the ECB is due up tomorrow. In our ECB preview, we talk about the potential for more QE, or at least hints about QE. That kind of chatter may put downward pressure on the euro broadly and against EUR/CHF.

What's next

A dip on the ECB decision would be an attractive place to buy. Depending on how dovish the ECB is, I think buying around the 21-day moving average at 1.0812 is an intriguing trade.

A fall below the lows near 1.0712 would invalidate the series of higher lows since June and would be a reason to re-think or exit the trade.