Major indices down for the 4th consecutive day

The European indices are closing lower once again with today's declines accelerating the fall. The indices have been down each day this week after peaking on Monday but failing to extend higher. The provisional closes are showing:

- German DAX, -4.0%

- France's CAC, -4.3%

- UK's FTSE 100, -3.7%

- Spain's Ibex, -5.2%

- Italy's FTSE MIB, -4.3%

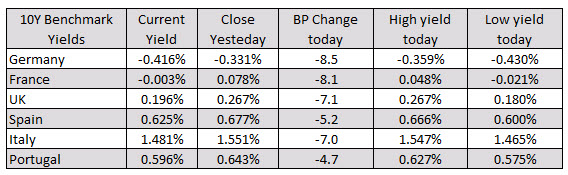

In the benchmark 10 year yields investors have been buyers across all countries today. The German 10 year note is down -8.5 basis points and is seen the most buying interest.

In the forex market, the CHF and JPY have extended their strength in the North American morning session. The USD remains positive but has lost ground vs. both the Swiss and the yen. The AUD, NZD and CAD remained the weakest as risk off sentiment prevails (see the rankings at the beginning of the North American session by clicking here).

- Spot gold is trading down $2.50 or -0.16% at $1736. That is off the low price of $1721.71. The high price reached $1744.73

- WTI crude oil futures are tumbling $3.07 or -7.75% to $36.53 as concerns about the lower recovery weigh on the energy complex

US stocks are sharply lower with the Dow industrial average currently trading down over 1100 points or -4.12%:

- S&P index -110.49 points or 3.47% at 3079.50

- NASDAQ index -259 points or -2.59% 9760.87

- Dow industrial average -1118 points or -4.14% at 25871.50

in the US debt market yields are lower and the yield curve flatter. The 2 year yield is actually up 0.6 basis points. The 30 year is down over -7 basis points. At 1 PM treasury will auction off 30 year bonds. There seems to be no concern about floating those bonds in the market (at least by the sharp fall in yields today). The 2-10 year spread as an hour to 50 basis points from 56 basis points near the close yesterday.