German DAX, -1.1%. France's CAC, -0.3%. UK's FTSE 100, -0.5%

The major European shares are ending the day in the red. The declines were led by the Italian and German markets. The provisional closes are showing

- German DAX, -1.1%

- France's CAC, -0.3%

- UK's FTSE 100, -0.5%

- Spain's Ibex, -0.4%

- Italy's FTSE MIB, -1.2%

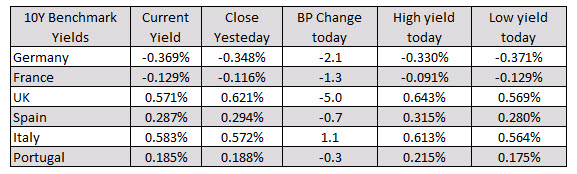

in the European debt market, the yields are ending mostly lower with UK yields down 5 basis points to leading the way. Italian yields are the only country with higher rates today. They rose by 1.1 basis point.

In other markets as London/European traders look to exit

- spot gold is trading down nearly $20 at $1774. The low price reached $1769.65 as flows followed the dollars movements (as the US dollar moves higher, the price of gold tends to move to the downside).

- Spot silver is down $0.11 or -0.39% at $27.12

- WTI crude oil futures are trading up $0.15 or 0.25% $60.20. It has had a volatile run falling from a high of $61.26 to a low of $59.43 on the back of a Wall Street article saying that Saudi Arabia was looking to rollback the voluntary production cuts.

- Bitcoin is trading up by $2497 or 5.13% at $51086. The high price reached $51,717.88

In the forex, the snapshot of the strongest to weakest shows the JPY is the strongest, while the CHF is the weakest. The US dollar is right below behind the JPY. The JPY crosses are all sharply lower on risk off flows (and tilts more to the negative side in the shorter term technicals).

In the US stock market the NASDAQ index is sharply lower at -1.6% at 13815. It's price fell below its 100 hour moving average at 13938.32. The next target comes around the 13725 area.

The S&P index is trying to stay above its 100 hour moving average at 3903.78. The low for the day reached 3900.43. It currently trades at 3904 just above the 100 hour moving average.

- S&P index -28.1 points at 3904.60

- NASDAQ index -236 points or -1.68% at 13811

- Dow industrial average -71.34 points or -0.23% the 31448

In the US debt market, the yields are lower despite the stronger growth and higher inflation. New buying at the higher levels reached today (10 and 30 year yields reached cycle highs earlier today) and flows out of stocks into bonds seems to be driving the flows. The US treasury will auction off 20 year notes at 1 PM ET.