Dip early in the week was bought.

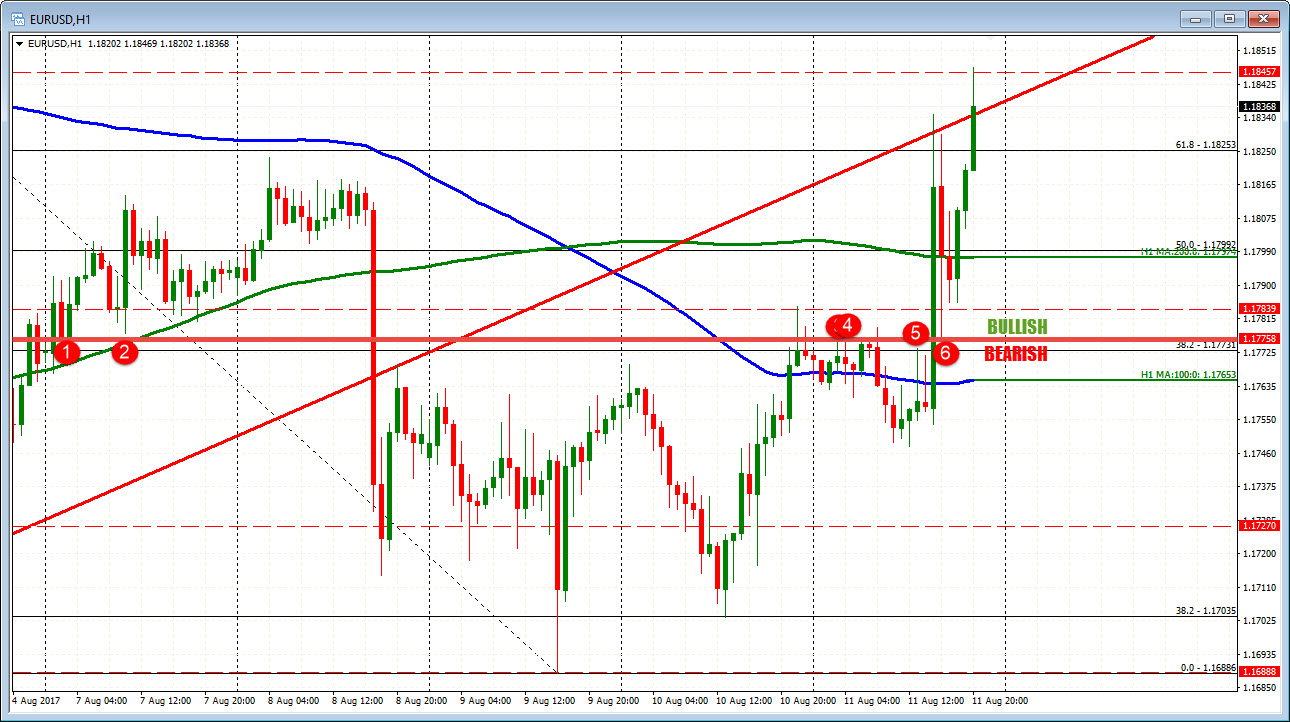

The EURUSD is making another run above the broken trend line at 1.1837. The high extended to 1.1847. The swing high from July 31 stalled at that level. There was a high bar from August 4 as well (see 4-hour chart below)

Stay above the trend line is more bullish. Move below, takes some of bullishness out. However, it is the week's end and overall, the price action today/this week is ending more bullish, with a key target above.....

That key target above is at the 1.1876 level.

Last week, the price traded above and below that level. The significance is it was the swing low going back to June 2010 (see weekly chart below).

With the week coming to a close, the EURUSD is looking like it will end the week:

- Higher overall. The price closed at 1.1771 last week

- Above the 200 week MA at 1.1776

- Above the 50% of the move down from the August high at 1.17992

- It may end above a broken trend line on the 4-hour chart at 1.1837, but

- Short of the 1.1876(swing low target from June 2010

That combination gives the buyers more control as we look to close the week.

I would put close risk for longs now at the 1.1800 level and keep the 200 week MA as another bullish above/bearish below line in the sand.

Although the price trading above and below that line in trading this week, the market pivoted around that level (see red circles in the hourly chart below).