The pair works it's way back to the years midpoint area.....(maybe, if lucky)

The EURUSD has chopped it's way around over the last few weeks. The chart below shows the chop.

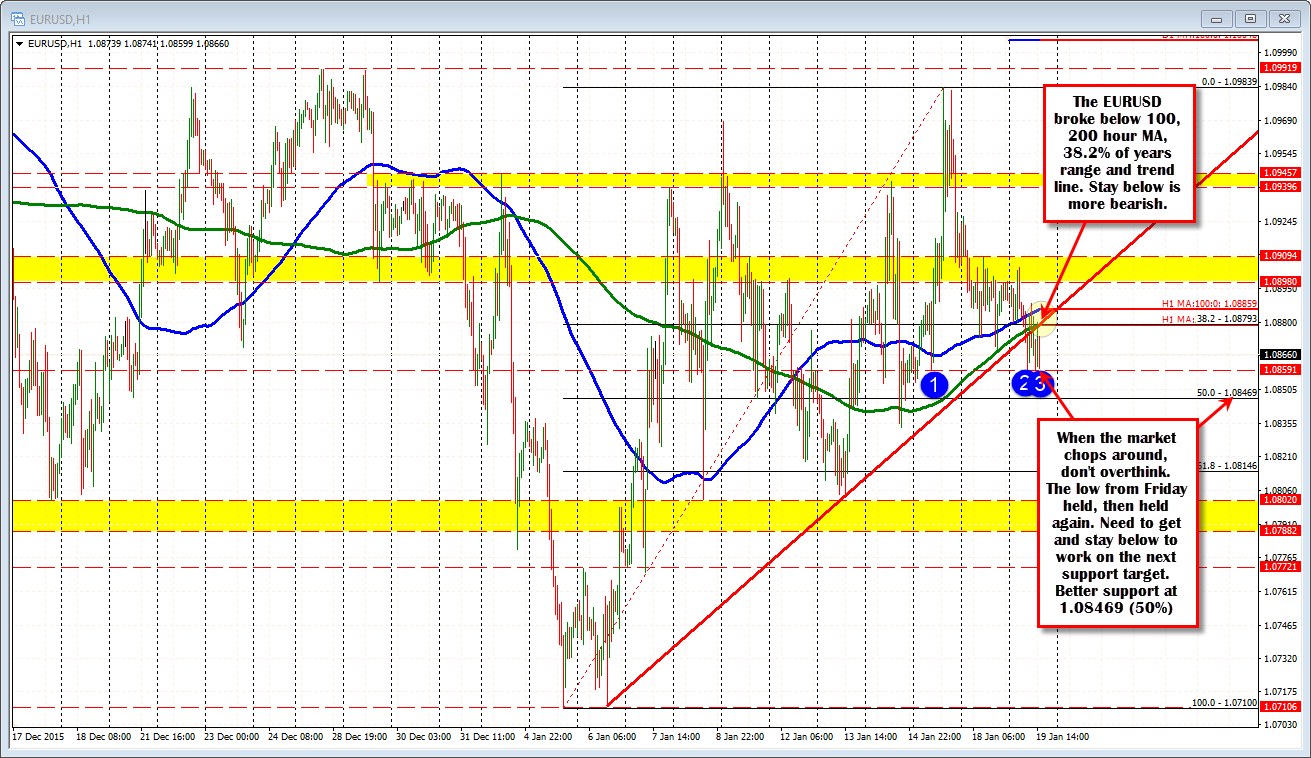

On Friday, a new high for the year was reached but the end of December highs at the 1.0992 could not be breached...Back down. Yesterday, the pair chopped it's way lower. Today more of the same chop with a downward bias. Looking at the hourly chart below the move lower today has taken the price back below the 100 and 200 hour MAs (blue and green line in the chart below) and trend line support. A swing low from Friday seems to have held the decline so far. Other support below comes in at the 50% of the years trading range at 1.08469.

When the market chops around like it is doing, traders look for little clues (i.e., the trend line and 200 hour MA). Those traders put a toe in the water and see what happens. They did that below the 100, 200 hour MAs and trend line. The 1.0859 level is another level. It isn't the strongest technical level but it held once and now held twice (see blue circles). It is not rocket science folks. Just traders leaning against levels that look good.

So going forward, what looks good? Look for sellers against the 1.0879 area. Stay below and a move below 1.0859 will have traders looking for 1.08469. A move below that opens other doors. If the price goes above the 1.0879 and 1.08859 (100 hour MA), the chop continues and the pendulum may start to swing the other way again with 1.0898-1.0909 the next hurdles. Such is life, when the markets chop.