Trading range still light

The EURUSD has trended higher since the release of the weaker UK data set the high for the dollar vs. the common currency. The rally has sent the pair up about 85 pips. The range is 91 for the day. The average is 131 pips over the last 22 trading days ( about a month of trading). So there is the potential for an extension. The best potential is if the trend characteristics continue.

Looking at the 5 minute chart above,the market has gotten a bit up and down in the last 30 or so minutes threatening the trend characteristics. The current move has taken the pair down about 27 pips from the high. The pair is testing the high price from yesterday's trade. The 38.2% of the move higher comes in at the 1.09157 level. If the buyers are to keep the strength and trend moving in the upward direction, I would look for buyers on dips in this area (yellow area). A move below this area might not sit well with the buyers. The up and down action is suggestive a market that is a bit more unsure at these levels.

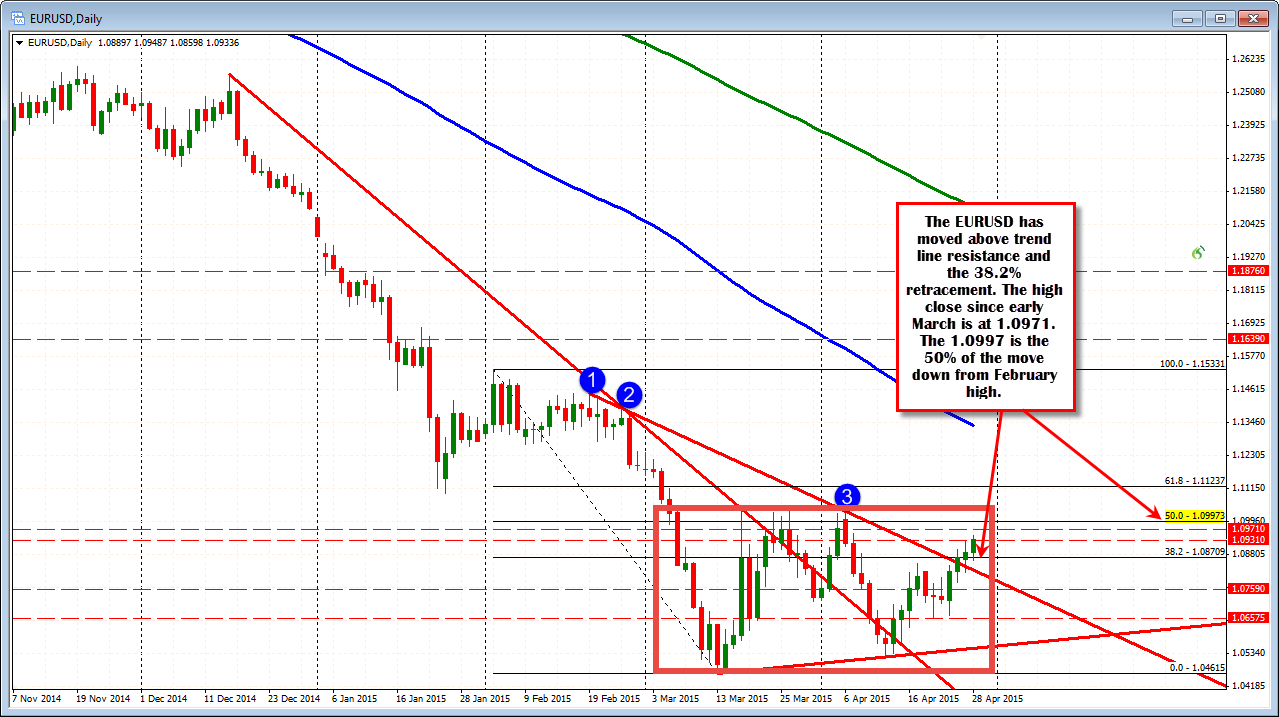

The daily chart below is showing a move above a topside trend line over the last few trading days. The price is also moved back above the 38.2% retracement of the move down from the February high to the March low (at 1.08709). The high close since March 5 comes in at 1.0971. . The 50% retracement of the move down from February comes in at 1.0997 (call it 1.1000). This natural level will be a level the market needs to get and stay above. Over the last month and the price has ventured above this key psychological level on 6 separate occasions. Each one failed to have a close above. It should continue to be a tough nut to crack as most traders still expect the parity level to be in play.

PS. a little birdy told me that the 55 day MA is at 1.0931 today and a close above would be the first close above since May 2014 (nearly a year ago). The EURUSD was trading at the 1.3850 area at the time. It has been a long journey down since then.