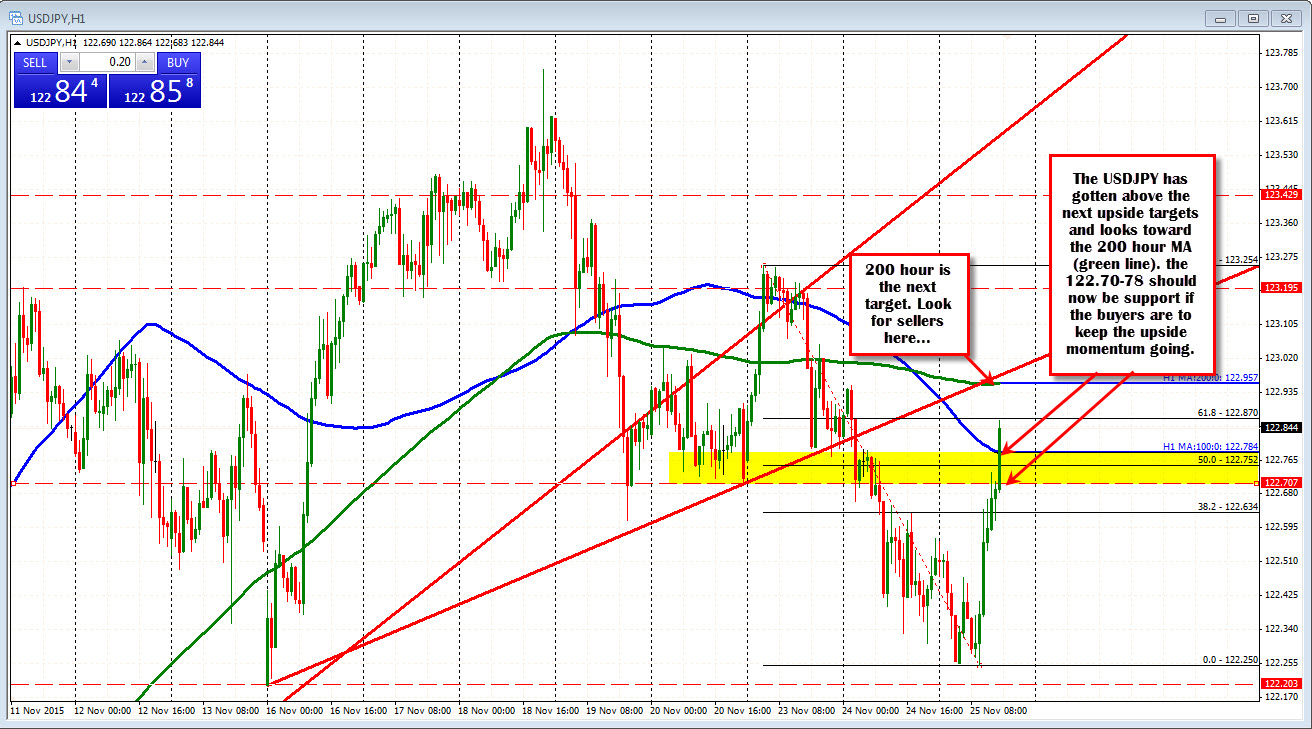

Price of USDJPY moves above the next upside targets

The USDJPY has moved higher after the US data came out...well a bit better than expectations.

Technically, the pair has moved above the 50% retracement of the weeks move down, and also above the 100 hour moving average at 122.78 (blue line in the chart above). The next key target is the 200 hour MA (green line) at the 122.957.

Yesterday - and into the new trading day - the pair had more of a downside bias, but the dollar buying in the European session, and the inability to get below the November 16 low (on the Monday after the Paris terrorist attacks), gave traders a reason to buy. The data today was enough to keep the momentum going. Look for the support to now be in the 122.70-75 area. Look, however, for sellers to show up on a test of the 200 hour MA. On Monday, the pair fell below the MA, come back to test it and fell off. On Friday (Nov 20) the pair also used the 200 hour MA as resistance. I would expect that longs from below would look to lean against that level on the first look (and for some intraday sellers as well). Stops on a move above though......