Moves back toward the 114.44-54 area but backs off

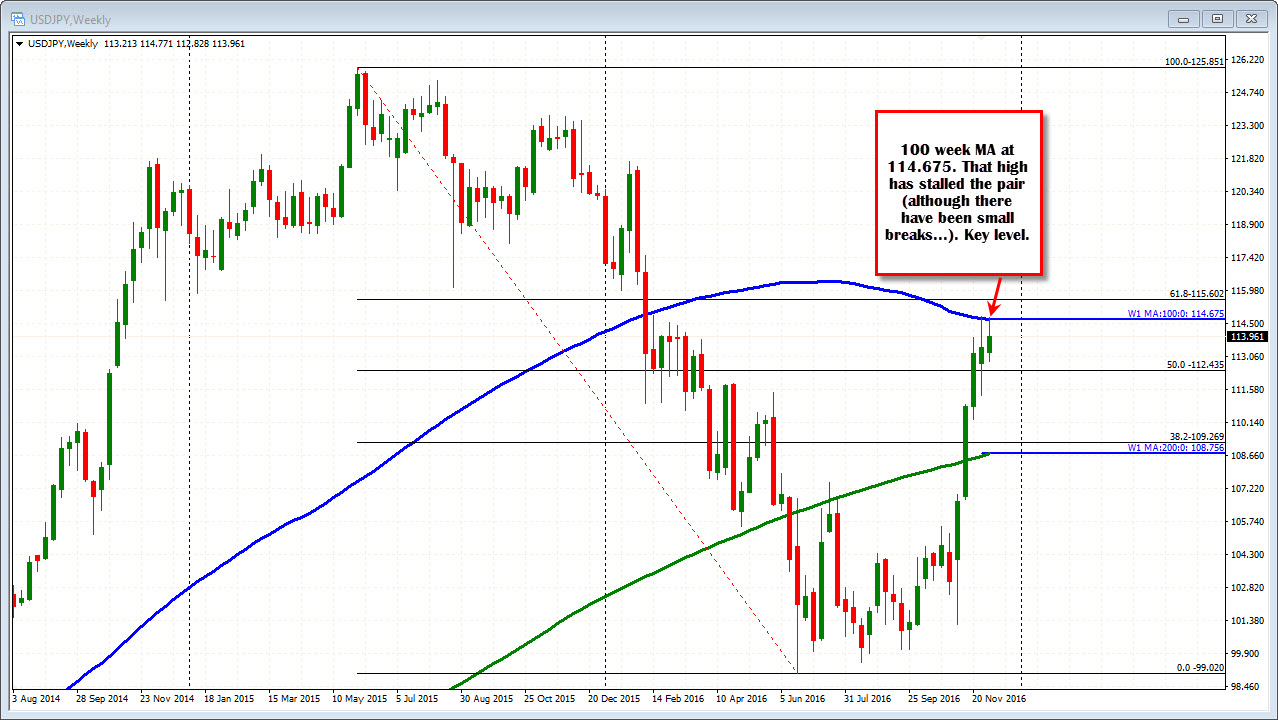

The USDJPY has moved higher off the firmer dollar tone. The pair moved above the 100 hour MA at the 113.84 level and pushed up to a high of 114.375. That was just short of the 114.44-54 area which corresponds with the swing highs going back to March 2016. Last week (and on Monday) the pair extend about that area but stalled before the mid Feb 2016 swing high at 114.86 (at 114.82). ON Monday, the price moved up to 114.77 but quickly retreated back below the topside yellow area. Sellers showed up. Today's peak at 114.37 (and yesterday's high which was also short of the area) shows that there are some sellers on rallies. The pair still consolidates.

In between those levels is the 100 week MA which cuts across at 114.675 currently. That is a key level as well to get and stay above if the buyers are to take more control going forward. It can also be a level to lean against if you think the bulls run is over for the time being.

The upside area is fairly clear. ON the downside, the 100 hour MA is a key level today at the 113.845 level. The 50% of the range today comes in at 113.74. On the move back lower today, the 100 hour MA was broken but the 50% was not. I consider the 50% retracement a level of importance for traders. THe close from yesterday at 113.74 is also at that 50% level. That is support intraday and could be the level that tips buyers to more sellers. Be aware of that area in trading today.

US yields are higher today but off the highs. The 10 year is at 2.3744%, up 3.4 basis points. The high yield spiked at 2.4234%. The high last week got up to 2.494%.

US stocks are near unchanged levels with the S&P trading above and below unchanged levels. The Nasdaq is up 0.12%. The Dow which rose close to 300 points yesterday is up 25 points or 0.13%.. The S&P and Dow closes at record highs yesterday. The Nasdaq came up short but is testing the record currently (and breaking it as I type).