A review of some of the major currency pairs

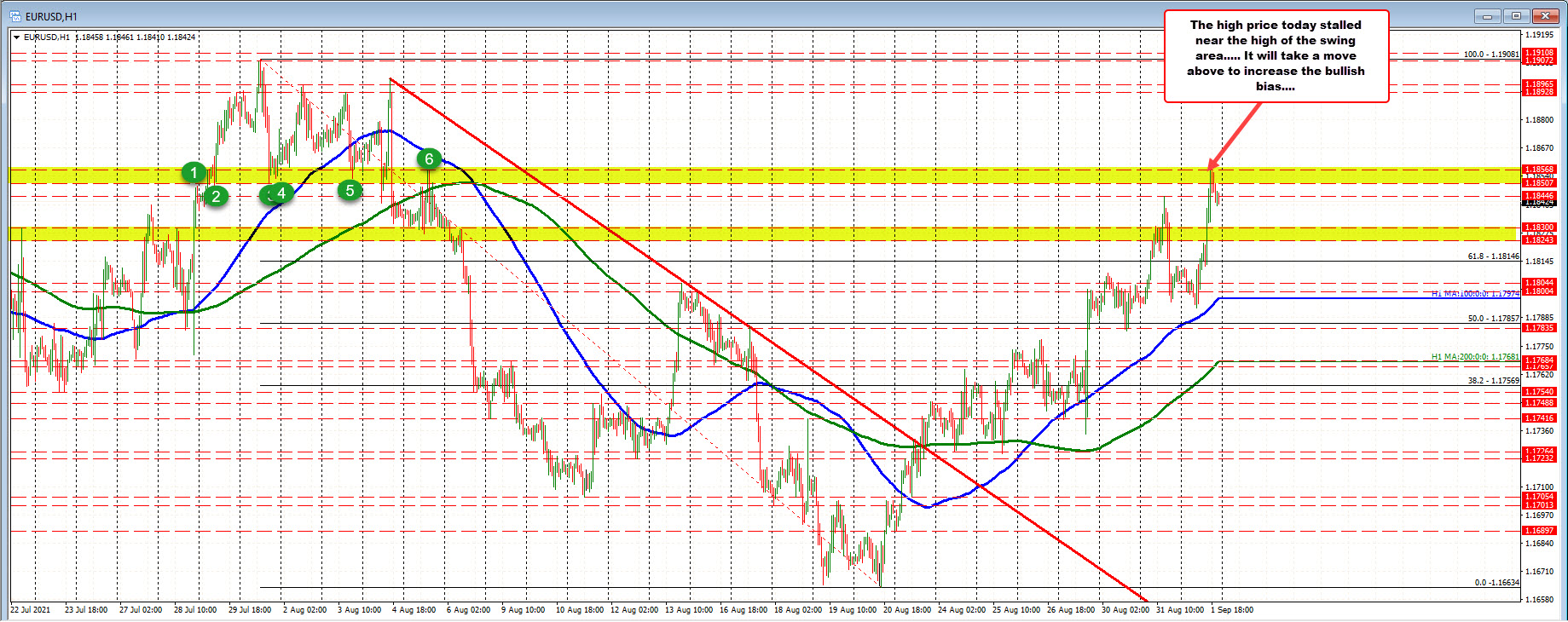

EURUSD:

The EURUSD moved up to test a swing area between 1.18507 and 1.18568. The high price reached 1.1856 and the price rotated to the downside. In the new trading day, traders will be eyeing that area above as a key target on the topside. Get above and stay above, and traders will start to look toward the swing highs from end of July in early August. The 1.18928 to 1.18965 becomes the next major target followed by the swing high from July 30 at 1.19081.

If the price can't get above the aforementioned swing area, would could start to see more sellers/profit taking. The price has been up eight of the last nine trading days. That has taken the price up from 1.16634 to 1.18568. Reaching a target area and finding sellers, could see some profit-taking with 1.18243 to 1.1830 as the next target followed by the 1.1800 area. The rising 100 hour moving average is moving up toward the 1.1800 (currently at 1.17974).

GBPUSD:

The GBPUSD fell below its 100 hour moving average early in the Asian session, but recovered and based against that moving average level before moving higher. The high price stalled within a swing area between 1.3790 and 1.3804. The later is home to the 200 day moving average. The 50% midpoint of the range since July 30 is at 1.37921. The current price trade at 1.3772. If the price is going to go higher, it has to get above the 200 day moving average. Yesterday the price stall stalled near that moving average. Today the price did the same thing (the high reached 1.37976). That could disappoint the buyers. The midpoint of today's moved to the upside comes in at 1.3764. Watch that level for close support.

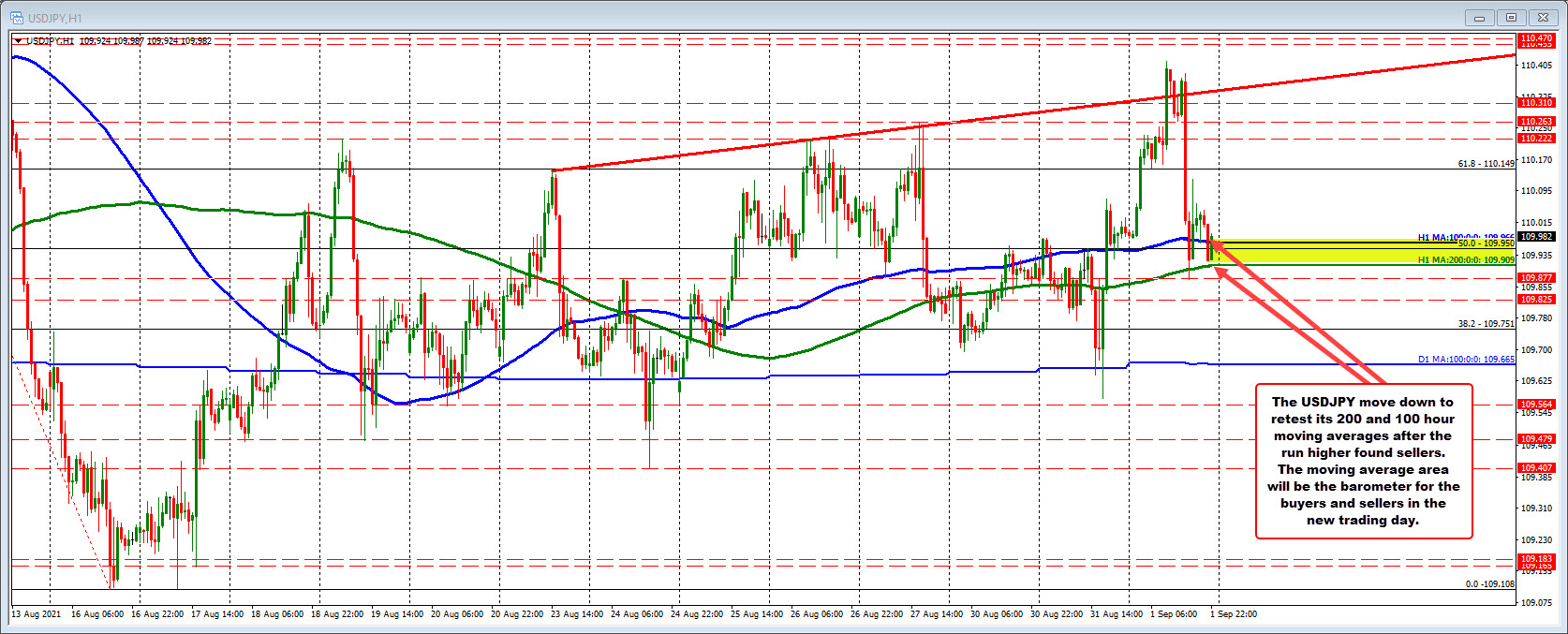

USDJPY:

The USDJPY moved higher to start the day, then moved lower to end the day. The low for the day move down to retest its 100/200 hour moving averages between 109.909 and 109.966. The 50% midpoint of the range since August 10 is between those levels. The current price is trading just above it 109.982.

The swing area will be the barometer for the buyers and sellers in the new trading day. Move below and the buyers shift more to the downside. If the price starts to show more upside momentum, we could see a rotation back toward 110.149 followed by the swing highs from last week at 110.22 and 110.263. The high price today extended up to 110.414.

USDCAD:

The USDCAD try to move above its 100 hour moving average yesterday and failed. It try to move above its 100 hour moving average today and it failed. The moving average currently comes in at 1.26247.

The move back to the downside today did find support, however, near the swing low going back to August 24 at 1.25778. Yesterday and on Monday, the price moved below that level on a number of hourly bars, but each time, the price moved back above. So there have been some buying support.

The current price is back higher and near the 100 hour moving average (it has tests against that moving average on three separate occasions in the North American session).

If the buyers are to take more control, getting and staying above that moving average - and then and the 200 hour moving average - at 1.26455, would increase the bullish bias.

NZDUSD:

The NZDUSD got within four pips of its 100 day moving average at 0.70811 (the high reached 0.7077) and within 11 pips of the August high of 0.7088. Sellers leaned early against the key level and the price is currently trading lower at 0.7069.

In the new trading day, if the price is going to extend further to the upside, getting above the 100 day moving average and high from August at 0.7088 would be the upside hurdles. Above that and traders would start to look toward the 200 day moving average at 0.7111.

Ultimately both the 100 and 200 day moving averages would need to be broken,. For a more bullish bias from the daily chart perspective.

AUDUSD:

The AUDUSD after trying and failing yesterday, moved into the consolidation trading range between 0.7316 and 0.7426 today. The moved to the upside to price up to a swing area between 0.73808 and 0.73885. Sellers leaned against that area and the price has moved marginally lower (trades at 0.73683).

If the price is to continue the run to the upside, getting above the 0.73885 level would be a more bullish development in the new trading day. That would open the door for a test of 0.7400 followed by swing highs from July 29 and August 5 near 0.7414. The high price from August reached 0.7426.