The euro is looking very sorry for itself

There's nowt but woe for the euro right now. There's not really that much going on, and the euro is usually the currency doing the least in this situation. However, this time we're seeing the single currency making all the moves.

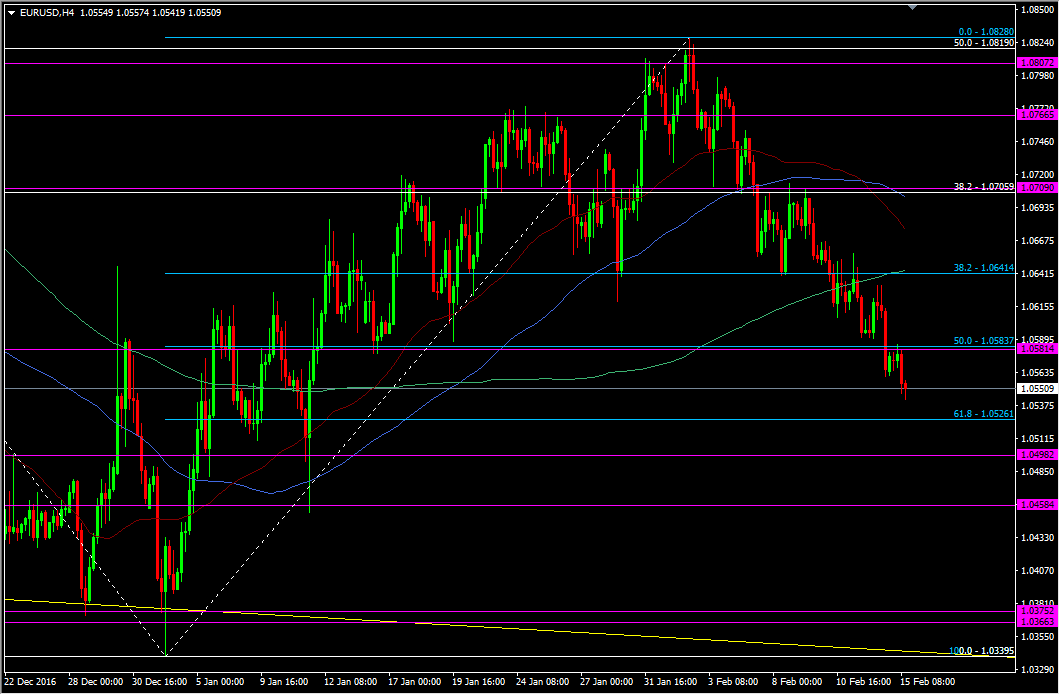

The move from up at 1.08 has been one way traffic, with bounces of note few and far between. The next support comes in around the 61.8 fib of the Jan swing higher at 1.0526.

EURUSD H4 chart

The fib area has been the scene of some fairly strong support going back to early 2015. It's pretty much from 1.0520/30. 1.0500 has also seen plenty of action. Looking intraday, 1.0560/65 is the nearest resistance followed by 1.0580/85 then 1.0590/1.0600.

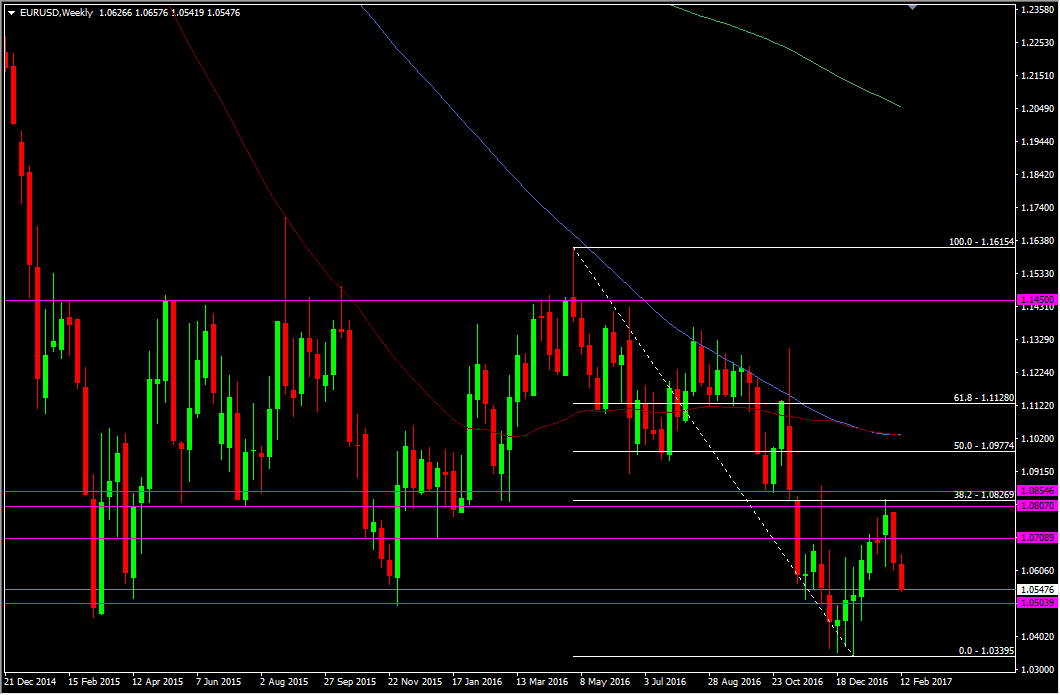

A break of 1.0500 will put the early year's lows bang in the crosshairs, and will bring out all the parity squawkers once again. Taking a wider look, you can see how important that level is.

EURUSD weekly chart

For those following my long trade, you'll know I'll start to get a bit more anxious if 1.0500 breaks. At the moment, my view is that there's quite a bit starting to stack up against the euro, Greece, elections, inflation ignorance. That's the main reason from the EUR side. On the USD side we've got a re-ignition of the Trump and Fed trade, though I'm still sceptical of both. My scepticism won't trump (pardon the pun) the price actions so as per my original plan, 1.0300 will be where I make a full assessment of the trade, should we go there. I may still lighten up some of the position into the French election (depending on where we are at the time) if the risk looks higher that Le Pen could win.

What's happening in markets is part and parcel of trading and holding positions. Just as I didn't get excited when we were up at 1.0800, I won't get too worried down here, though naturally human emotions grow quicker when things go wrong than when they go right. At the end of the day you make your judgment and you make your trade. You try and point yourself in the right direction but you have to let the wind carry you where it wants.

The most important part of my trade is the one I detailed right from the start;

"Whatever happens to the trade there's one important factor to consider, and it's something every trader should consider, and that is that I'm am prepared to lose what I am going to stake on this trade. When I trade long-term I'm prepared to risk a bit more than normal but nothing excessive. I will know what I may lose from the get go, and I will be prepared for that. There will be no shocks, no 'deer in the headlights' moments, no "what now?" questions if I go offside. I'll know where I want to get in, and I'll know where I'll throw in the towel. I may win, I may lose, that's trading but at all stages of the trade I'll be in control of it, not it in control of me. If I avoid the long road to ruin, I'll be a happy man at the end."