The EUR is back mixed after wild ride in Asia and Europe session

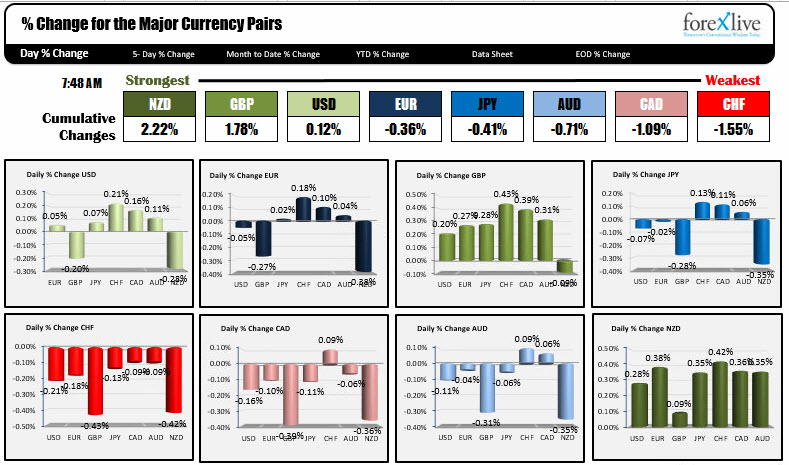

As North American enter for the week (well holiday shortened week in the US), the NZD is the strongest while the CHF is the weakest. The EUR - which went on a German coalition roller coaster - fell sharply in the Asian session but recovered in the European session. The USD is also mixed (with little bias higher). The greenback is lower vs. the GBP and NZD, but higher vs the rest of the major pairs (but not by a whole lot).

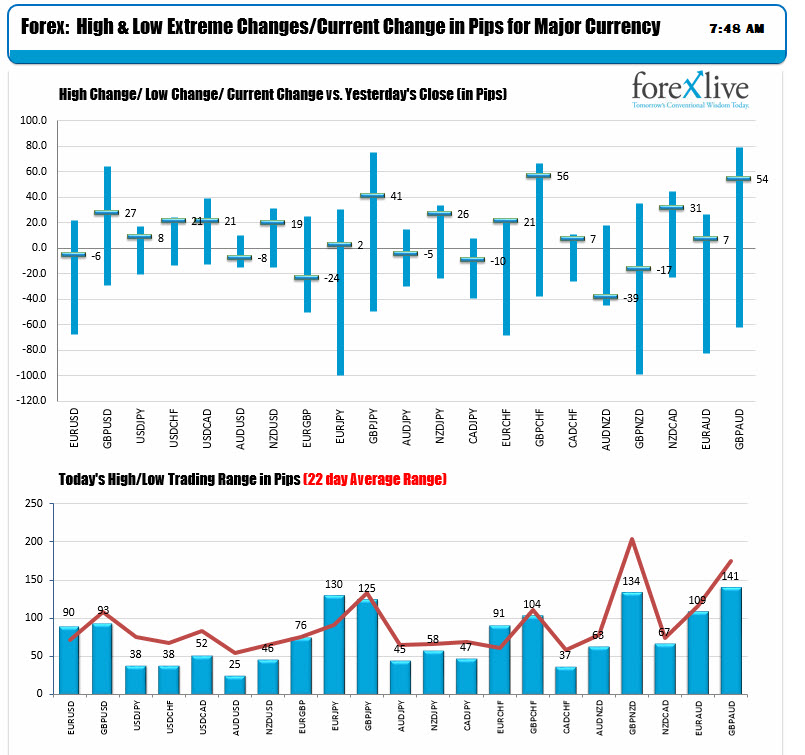

Looking at the changes and ranges, the ranges for the EUR pairs have all surpassed or gotten close to 22 day averages as a result of the volatility, but trading back near higher levels. We should probably expect more volatility going forward today (and perhaps through the week as well). The week is the Thanksgiving Day holiday on Thursday which tends to lead to Friday being an off day for traders, and Wednesday being a semi holiday as well. Lower liquidity with news can lead to wild swings (like last nights tumble lower in the Asian session). Low liquidity can also mean very quiet, ranges as no one is there to push the market one way or the other. You just don't know, but you have to be prepared (or decide to sit out too).

A snapshot of the other currency pairs shows:

- Spot gold down -$1.00 or -0.08% at $1293.16

- WTI crude oil is down -$0.30 or -0.53% at $56.25

- US yields are a bit lower: 2 year 1.717%, down -0.3 bp. 5 year 2.047%, -1 bp. 10 year 2.3346%, -0.8 bp. 30 year 2.7716%, -0.6 bp

- US stock futures in pre-market trading shows markets are little changed: S&P futures are down -1.0 point. Nasdaq futures are up 3.25 points. Dow futures are down -2 points