Vix index moves to 40 area

The Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

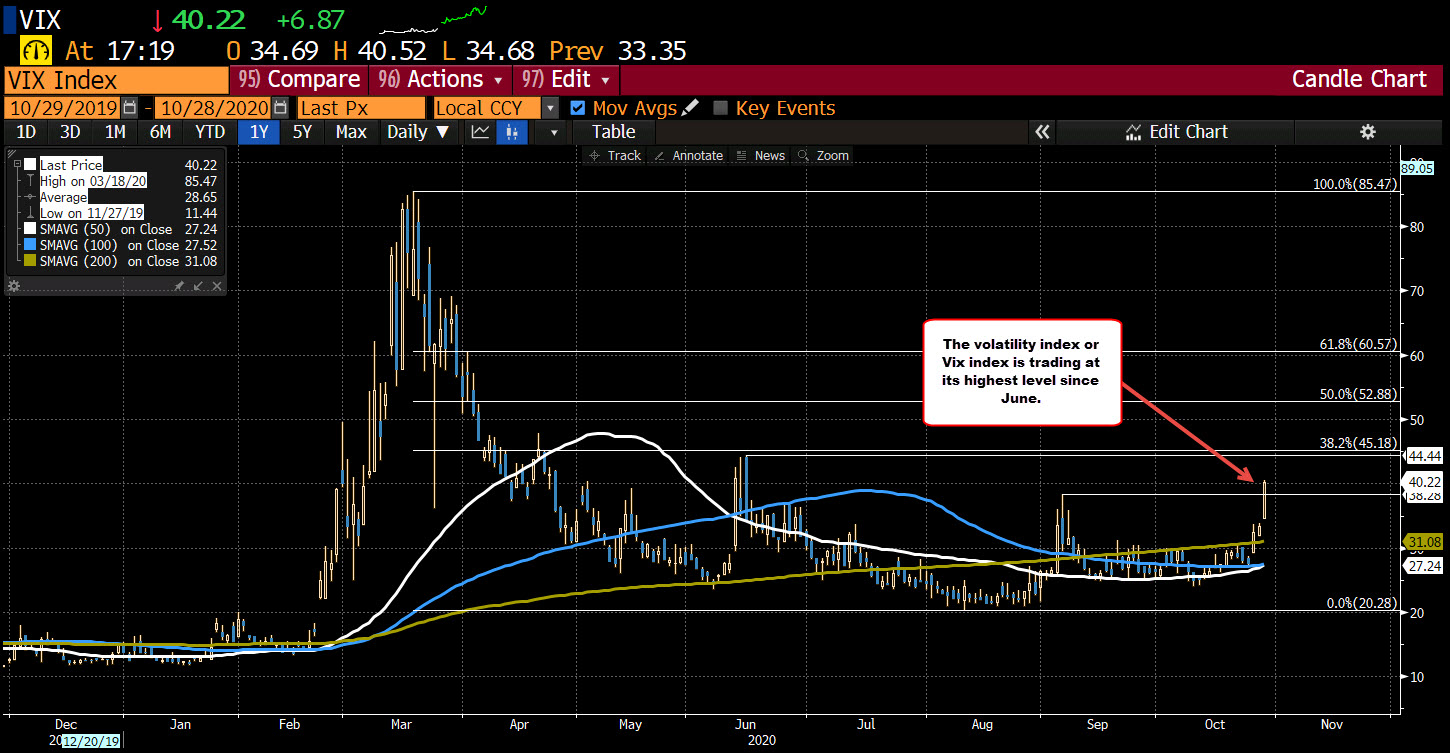

The index today, has shot up to just above 40 (currently at 40.24). That puts the index at the highest level since mid June. High level in June reached 44.44. The March peak extended all the way up to 85.47. Today's move took the price above the September high at 38.28.

Stocks continue to push to the downside. The S&P index is now down 3.22% to 3281.77 the low price just extended to 3279.62. The NASDAQ index is down 391 points or -3.4% to 11042.59. It's low for the day reached 11033.516.

Volatility is certainly picking up but is still below other pandemic highs seen earlier in the year.