EURUSD extends the narrow trading range for the week.

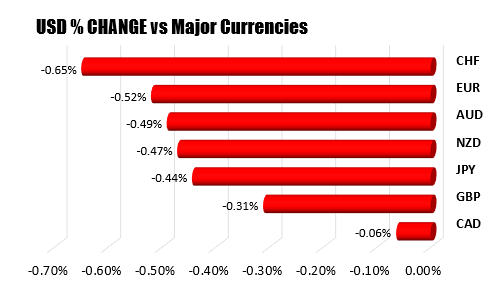

The USD has trended/extended lower after the what we can expected Michigan consumer sentiment. The biggest mover is the USDCHF. The dollars decline verse the CAD is little changed as the loonie and USD follow each other today.

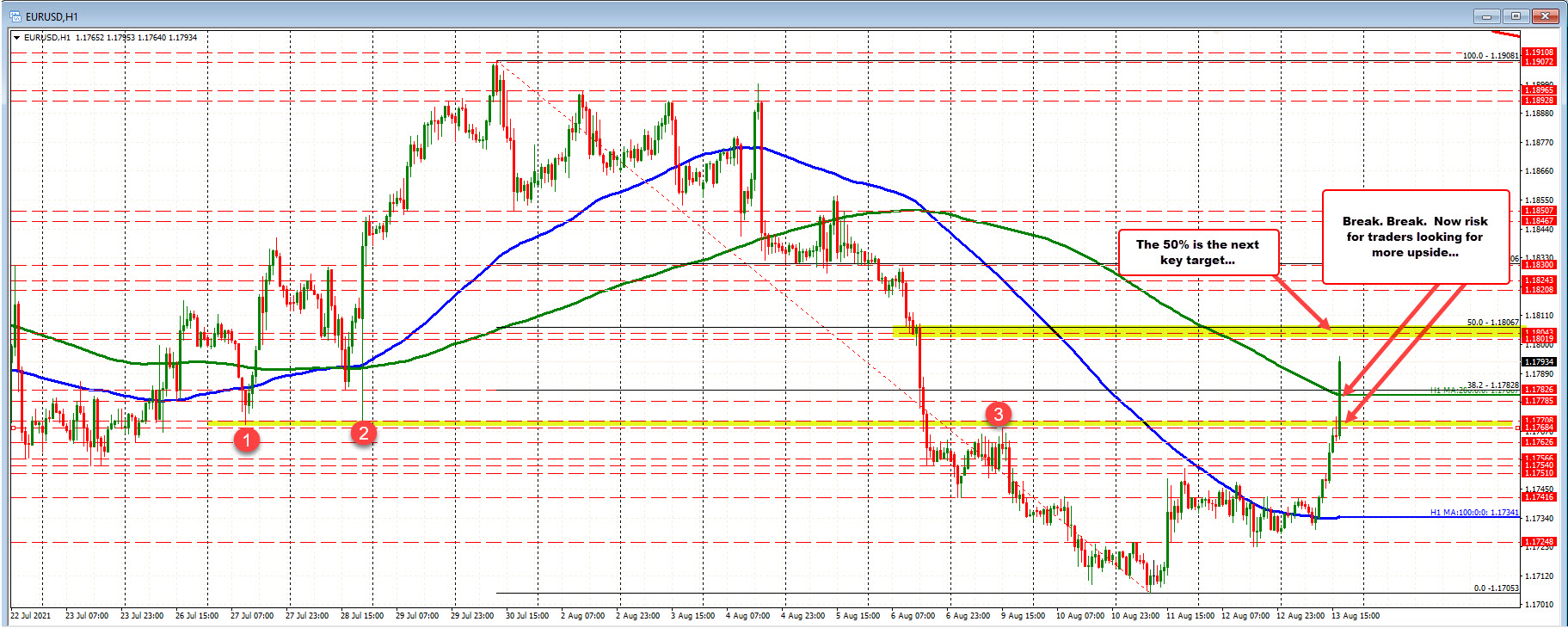

EURUSD. The EURUSD trading range for the week was at 63 pips coming into the day. The last seven hours has seen a 62 pip trading range and in the process extended the range for the week to a more respectable 85 pips. Even so, the range is still near the lows seen over the last two years of trading (the low range for a week was around 76 pips).

The moved to the upside has taken the price above the 200 hour moving average and 38.2% retracement near 1.1782. Stay above that level and the buyers remain in control in the short term at least. The price is currently trading at 1.1791. The next target comes in near 1.1802 to 1.18067 (highlighted by the 50% retracement at 1.18067).

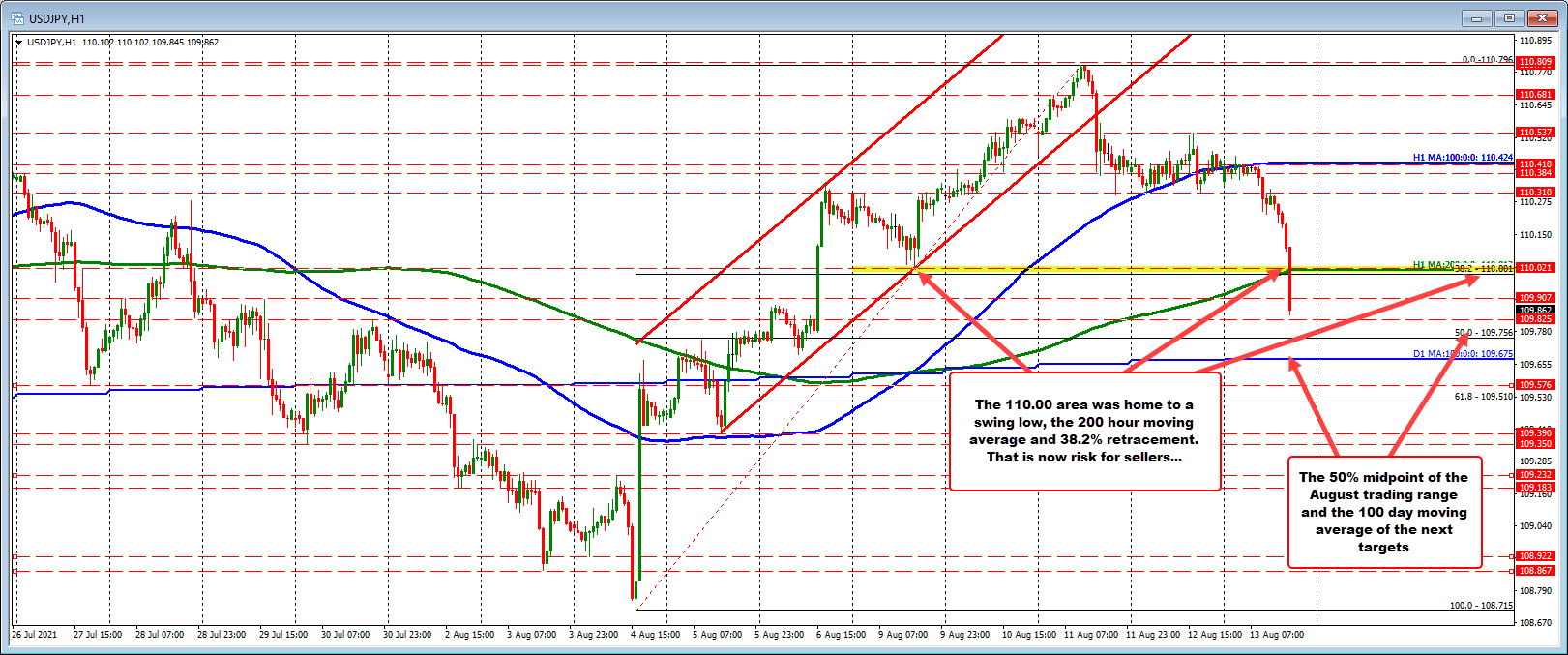

USDJPY: The USDJPY moved below its 200 hour moving average and 38.2% retracement, and the swing low from August 9 all around the natural support level at 110.00. The price has trended down to a low of 109.84. The next key target comes in at the 50% of the August trading range near 109.756. Just below that level is the 100 day moving average at 109.675.

For traders, stay below 110.02 keeps the bias in the direction of the shorts/sellers.

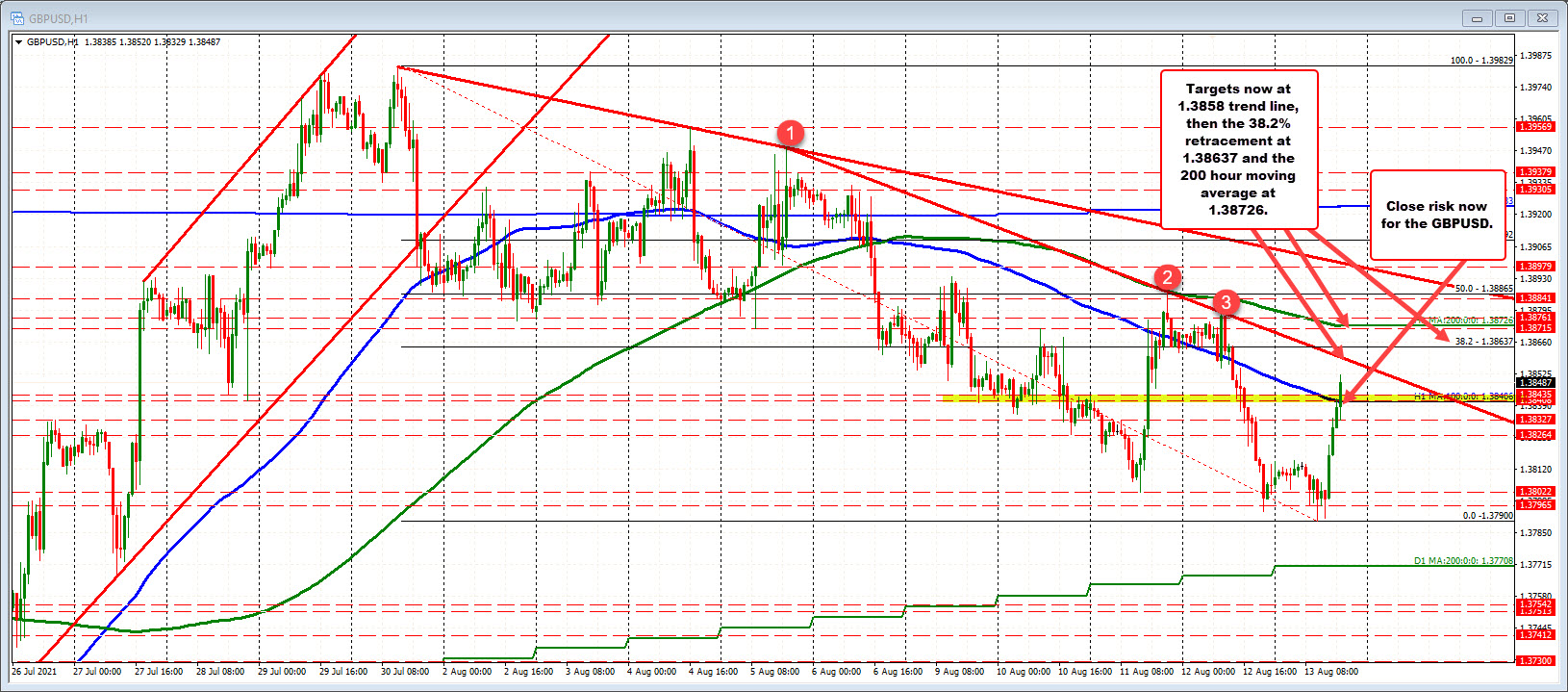

GBPUSD: The GBPUSD moved above its 100 hour moving average at 1.38406 and a swing area between 1.38406 and 1.38435. The high price reached 1.3852. A doubts open trendline connecting highs from August 5, August 11 and August 12 on the hourly chart cuts across at 1.3858. The 38.2% retracement of the move down from the July 30 high comes in at 1.38637 and eight 200 hour moving average is moving down to 1.38726.

Close risk for the buyers now comes in at the 100 hour moving average. Recall from yesterday, the price moved below that level retested that before moving sharply to the downside.

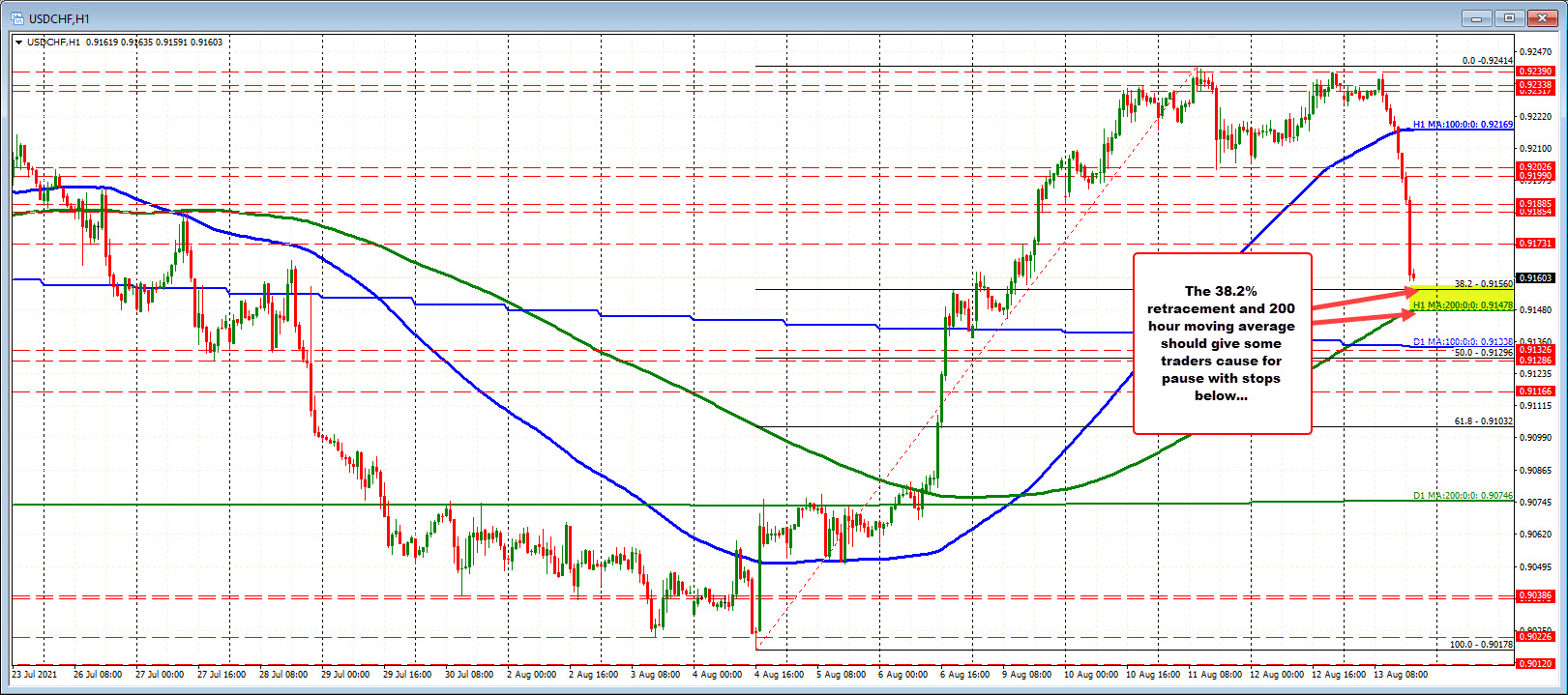

USDCHF: The USDCHF is the biggest mover today and is approaching the 38.2% retracement of the August trading range at 0.9156. The rising 200 hour moving average is not far from that level at 0.91478. Finally the 100 day moving averages at 0.91338. The range for the day's at 79 pips. That is well above the 53 pip average (151% of the normal range). Traders may stick it on the water between the 200 hour moving average and 38.2% with stops below.

USDCAD: The USDCAD is testing a trendline near 1.2504 and below that a swing line at 1.2500. The pair has been less trendy than the other currency pairs vs the USD but is still reaching a new low for the day. The range is only 27 pips vs the 22 day average of 82 pips.