USD/JPY trades up to test the 114.00 level

The yen is the laggard to kick start the session as the rest of the major currencies bloc are keeping steadier for the most part amid lighter trading conditions so far.

USD/JPY is seen pushing up to 114.00 again with the risk mood also keeping more positive as we get things underway in European trading. Of note, the pair is now contesting near-term resistance from its key hourly moving averages at 113.93-00.

Hold a break above and the near-term bias switches to being more bullish instead. That will be a key focus area to watch with little else for traders to work with.

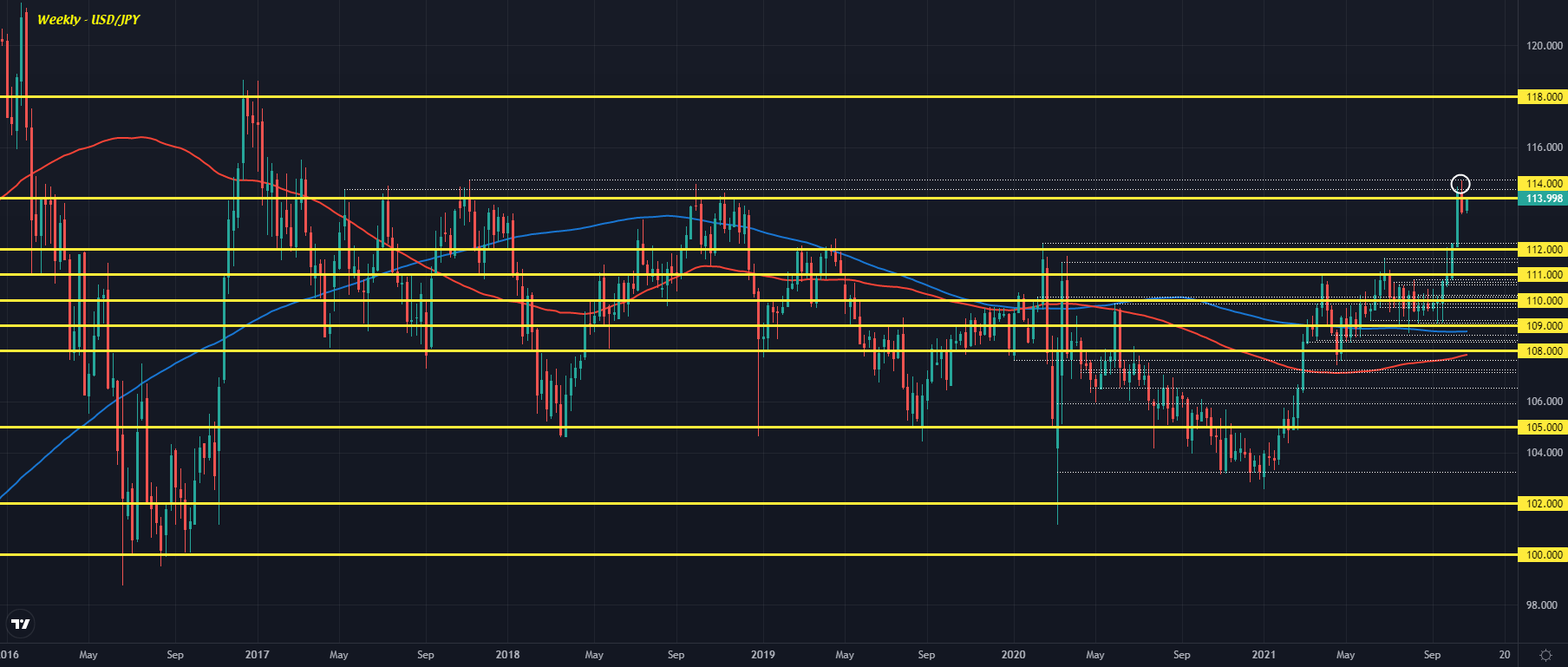

While a push above 114.00 may entice buyers to have more conviction, the weekly chart underscores that more work needs to be done for the upside momentum to extend:

The break above 114.00 two weeks ago was encouraging but gains last week fell short of contesting and breaching the November 2017 high of 114.74, resulting in a light pullback coming into this week.

As such, that will remain a key resistance level/region to watch if buyers can seize back near-term control - in terms of justifying any further extensive breakout.