Yellen will have a long way to climb down if the US economy isn’t all it’s cracked up to be

Market participants are debating about whether Yellen was dovish or hawkish yesterday but one thing that really stands out his how confident she was in an economic pickup. That faith might be misplaced.

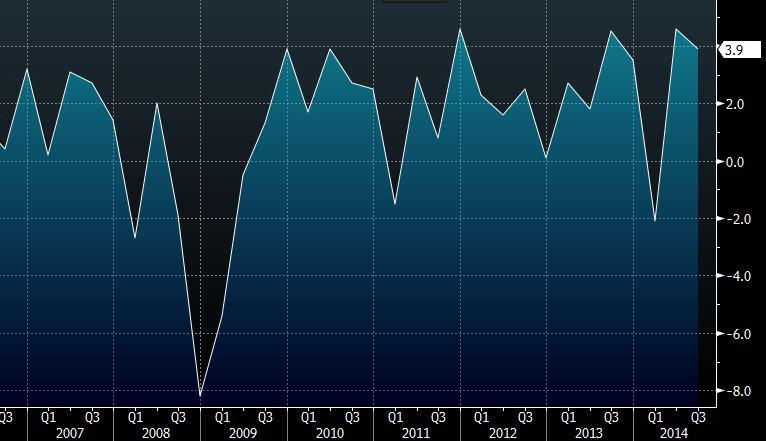

The Fed believes the economy is accelerating but it could be mired in the same low-growth trap as the past 5 years. Q2 and Q3 were the best two consecutive quarters of growth since the crisis and the Fed is extrapolating that to mean growth is picking up but it could be an illusion.

US GDP quarter-over-quarter annualized

It might just be pay-back for an exceptionally weak first quarter — the worst since the crisis.

If you tally it up, it looks like growth this year will be around 2.3% — the same as it was the past two years.

It’s easy to see why the Fed is making this mistake. All the elements in the economics textbook are in place for a pickup and historically, this is the time when companies would start putting money to work.

The Fed has failed to understand that we’re in a prolonged deleveraging that’s leading to a secular stagnation. They would be wise to look North where Canadian officials spent every year since the crisis expecting the same kind of pickup before Bank of Canada Governor Stephen Poloz finally declared they would stop predicting an acceleration and wait and see because of ‘serial disappointment’ in the economy and the disinflationary effects of globalization.

In many ways, the elements were better in Canada. The crisis was little more than a speedbump, housing continues to roar and until recently, commodity prices remained high. But the growth and inflation never materialized.

In piling into US dollar, the market might be making the same mistake.

Janet Yellen after FOMC Dec 17 2014