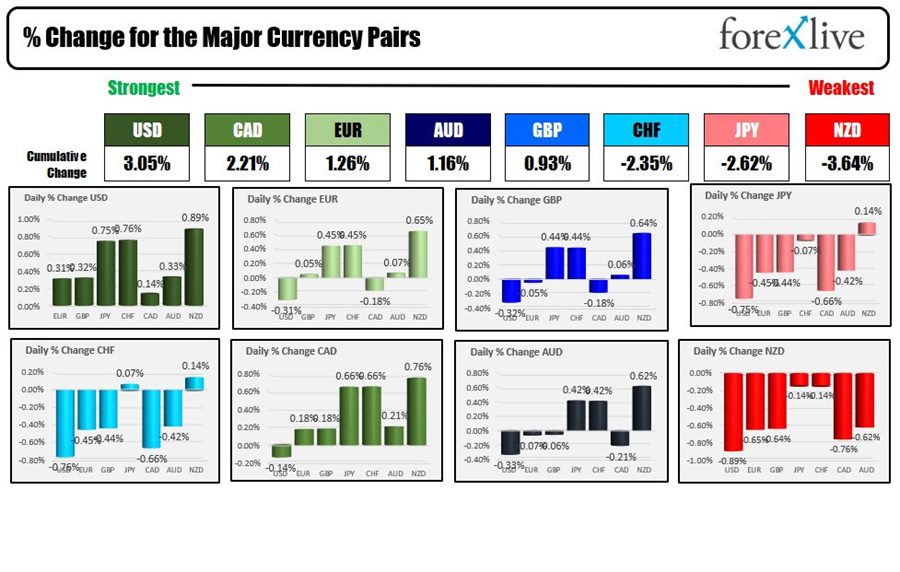

The USD is the strongest and the NZD is the weakest as the North American session begins.

Overnight the RBA raised rates by a greater than expected 50 basis points. The AUDUSD moved higher but then tumbled back to the downside after the pair was able to get above the 100 day MA but fell short of the higher 200 day MA (at 0.7226 and 0.72519).

The JPY took another leg to the downside as the hike from the RBA highlights the disparity of central bank policy as Kuroda and the Bank of Japan continue their stimulative monetary policy (see post here talking to this idea). The USDJPY moved to a new high at the natural level of 133.00.

The NZDUSD and the USDCHF are also seeing moves in the favor of the greenback today. The GBPUSD is mixed after PM Johnson survived the vote of confidence yesterday.

Target warned investors that they would be marking down inventory. They have too much inventory now, but sees better profit margins later in the year (or that is the hope) The push-me/pull-me implications of the Covid continue, but it should be good for inflation. That has helped to lead to pre-market declines in US stocks.

Crude oil is lower after a run above $120 yesterday (near $121) stalled. The price is back to $118.00. Natural gas is higher however and traded to a new high at $9.529 today. The price of gas at the pump in the US is approaching $5.

A snapshot of the markets ahead of the jobs data are showing:

- Spot gold is trading up $5 or 0.27% $1845.36

- Spot silver is down $0.15 -0.68% $21.97

- WTI crude oil is trading down $0.50 and $118

- Bitcoin is trading trading back below the $30,000 level at $29,466.

In the premarket for US stocks, the futures markets are implying a lower level

- Dow is trading down 230 points after yesterdays 16.08 point rise

- S&P index is down -35 points after the 12.89 point rise yesterday

- NASDAQ index is down 130.8 points after yesterday's 48.64 point rise

In Europe: the major indices are lower after solid gains yesterday

- German DAX down 162 points or -1.11% at 14492

- France's CAC down 68.27 points or -1.04% has 6480.52

- UK's FTSE 100 is down -16.89 points or -0.22% 7591.27

- Spain's Ibex is unchanged at 8836

- Italy's FTSE MIB down -284 points -1.16% at 24280

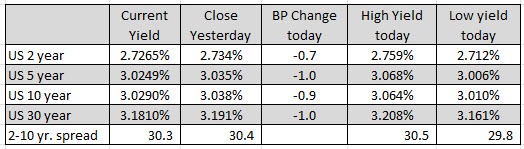

The US debt market this morning, yields are moving marginally lower: