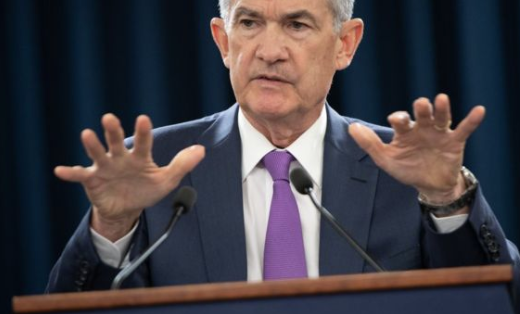

Federal Reserve Chair Powell:

- Business debt at historic levels should cause businesses and investors to "pause and reflect"

- Warns that while growth in business debt appears to have moderated, another fast rise could increase vulnerability "appreciably"

- Says it is "good news" that large banks hold only $90b of the $700b collateralized loan obligation market, but fed would "benefit" from more information on who holds the rest

- Says level of business debt would not lead to "broad harm" if economic conditions deteriorate, though individual borrowers could face "severe strain"

- Sees overall moderate risks to financial system of high levels of business borrowing, considers debt growth product of long economic expansion

- Says Fed takes seriously risks of "opaque" financing as source of fast growth of business debt

- Says comparison of current business debt levels to subprime mortgage crisis "not fully convincing"; stronger financial system, lack of asset bubbles among differences

- Business sector healthy overall, with debt servicing costs low relative to income

I guess we all really wanted to hear Powell say when he was cutting rates

Nope, not today!

:-D

Calm down folks!