Highlights of the Bank of Canada Q4 Business Outlook survey

- Prior was 19.0

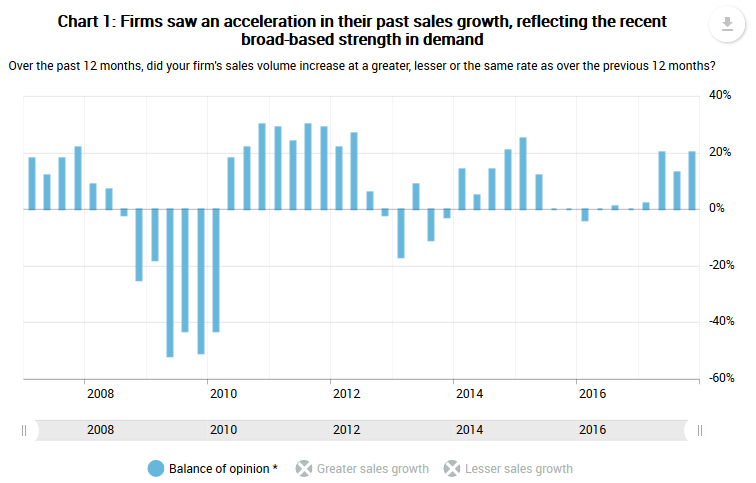

- Did sales grow over past 12 months +20 vs +13 prior

- Investment intentions +29 vs +17 prior

- Hiring +40 vs +34

- Ability to deal with unexpected increase in demand. 'Significant difficulty' +12% vs 9%

- 'Some difficulty' 44% vs 38%

- Intensity of labor shortage 38% vs 35%

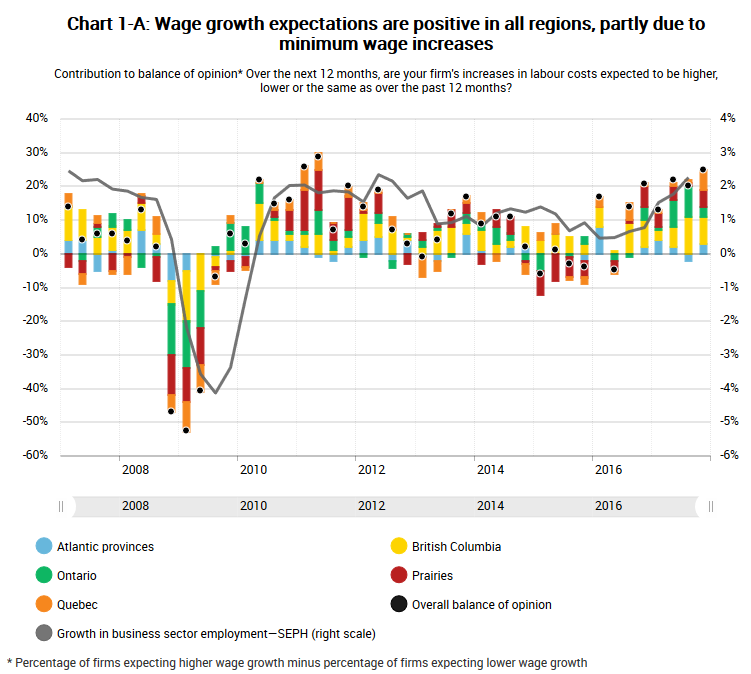

- Input costs expected to grow 26% vs 0%

- Output costs expected to grow +2% vs 0%

- Inflation expectations and credit conditions little changed

- Business Outlook Survey Indicator 2.49 vs 0.83 (close to Summer peak)

- Expectations for sales activity remain positive but point to some moderation ahead

- Indications of capacity pressures and labor shortages picked up 'reflecting strong demand and tightening labor markets'.

- Many firms expect stable sales growth or a return to a more sustainable pace, especially in goods sector

- Economic slack now largely limited to energy producing regions

- Rising labor costs, often related to minimum wage rises and non-labor inputs, to put upward pressure on output prices

- Firms plan to expand operations to accommodate sustained demand

- Views on the US economy have strengthened due to expectations of upcoming tax reforms and strong US consumer demand

- Full report

Aside from the dip in the future sales metric, there are plenty of reasons for the BOC to hike there. I think this solidifies the case for a rate rise on January 17. In addition, the wage indications are moving higher.

- Senior loan officer survey -6.4 vs -0.5

A softer balance was likely expected due to higher rates and tightening rules.