Via eFX:

- All eyes will be on the ECB meeting on Thursday following comments from the Governing Council, which have been mixed, but key members, including ECB president Mario Draghi, vice president Vitor Constancio and Benoit Coeure, have sounded amenable to further policy adjustments, notes BNP Paribas.

- “Our economists expect next week’s meeting to include the announcement of a broadening of the range of assets the ECB intends to buy in tandem with a downward revision to already-low staff inflation projections. Comments should support an increase in expectations of full sovereign QE in Q1,” BNPP projects.

- “We expect the outcome of the meeting generally to be bearish for the EUR, even though a more significant depreciation probably requires a marked rise in inflation expectations,” BNPP adds.

- “We remain short EURUSD and EURGBP heading into December,” BNPP adds.

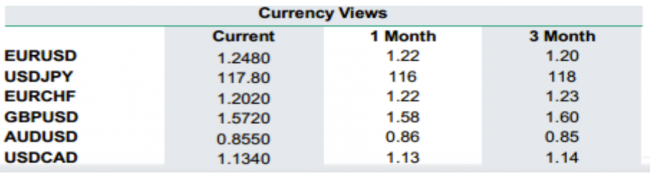

- In its portfolio, BNPP maintains a short EUR/USD position from 1.2520 targeting 1.18 and and a short EUR/GBP position from 0.7990 targeting 0.7757.

More investment bank research and trade recommendations are available at eFX