Unquestionably, you will have noticed that your groceries are becoming more expensive each month.In fact, for months now, everything is priced higher, with consumers all around the world witnessing higher prices for bread, milk, crops, fruits, and vegetables.

Grocery prices have risen 13.1% in the last year, the biggest yearly increase since the fiscal year ended in March 1979.

The primary causes behind this significant surge in the prices are discussed below:

World food situation and Food Price Index

The Food and Agriculture Organization (FAO) of the United Nations released its World Food Price Index (FFPI) on April 8, 2022, and stated that the food price index reached an all-time high in March 2022, attributing this to volatile worldwide socioeconomic conditions.

The FFPI measures the monthly change in the price of a basket of food goods, such as cereals, vegetable oil, sugar, meat, and dairy products.

FAO Chief Economist, Maximo Torero, has cautioned that prices will not return to normal anytime soon. Furthermore, Torero stated that prices would continue to rise since the world has lost the typical planting season in two main nations: Russia and Ukraine.

Ukrainian-Russian Clash and Global Food Supply

The global economy was breathing sighs of relief after struggling for 2 years due to the Covid-19 pandemic, but it seemed that the relief was short-lived; by February 2022, the war between Russia and Ukraine started.

In a dramatic escalation of the Russo-Ukrainian crisis, which started in 2014, Russia declared war on Ukraine on February 24, 2022. As a result of the ongoing war between the two nations, Europe witnessed the worst refugee crisis since WWII. It is estimated that, approximately, 7.1 million Ukrainians had fled the country, whilst one-third of the population was internally displaced.

Hereinafter, governments around the world acted against Russia by taking financial measures and sanctioning Russian banks, businesses, and gas and oil exports.

Accordingly, this induced the two main catalysts for the global food supply crisis: energy prices soared recording decades high prices, and it also created the inability to produce and export agricultural crops.

Production Shortage and Exporting Difficulties

Wheat, a pantry mainstay, is the most problematic.

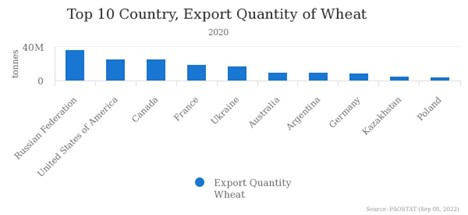

Russia ranks top country for wheat exports in the world, whereas Ukraine is ranked as the 5th world supplier. The two countries combined produce more than a quarter of the global wheat supply.

As a result, interruptions in any of those two markets can potentially trigger enormous shocks in the global food supply, as itis estimated that for 50 countries, 30% of wheat imports comefrom Russia and Ukraine, whereas for 20 of those countries, wheat import depends solely on Ukraine by 50%.

Wheat Import Dependency, net importers, 2021(%); Source: Trade Data Monitor (TDM), FAO calculations, March 2022

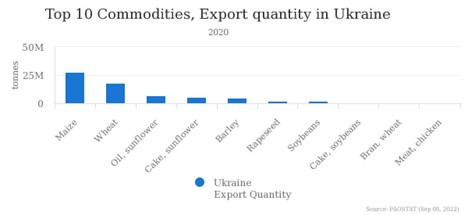

Moreover, Ukraine is one of Europe's biggest bread baskets. It is a major source of Europe's agricultural produce.

Top 10 Commodities, Export Quantity in Ukraine; Source: FAOSTAT, September 08, 2022

However, many of these agricultural products haven't been able to depart the nationas a result of the blockade of Ukrainian ports. Equally important, farmers who were expected to be planting crops for the following season have, likewise, been incapable of doing so.

Soaring Energy Prices and Agricultural Production Costs

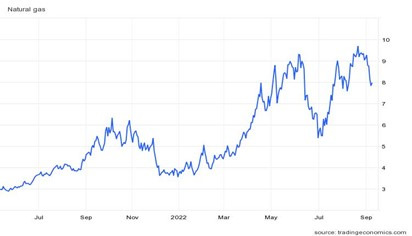

As economies started reopening following the strict Covid-19 lockdowns and worldwide shutdowns, global gas and energy costs witnessed notable growth due to increased demands and regional rivalry for supply. With prices already soaring prior to the conflict, the Russian-Ukrainian crisis severely exacerbated the situation.

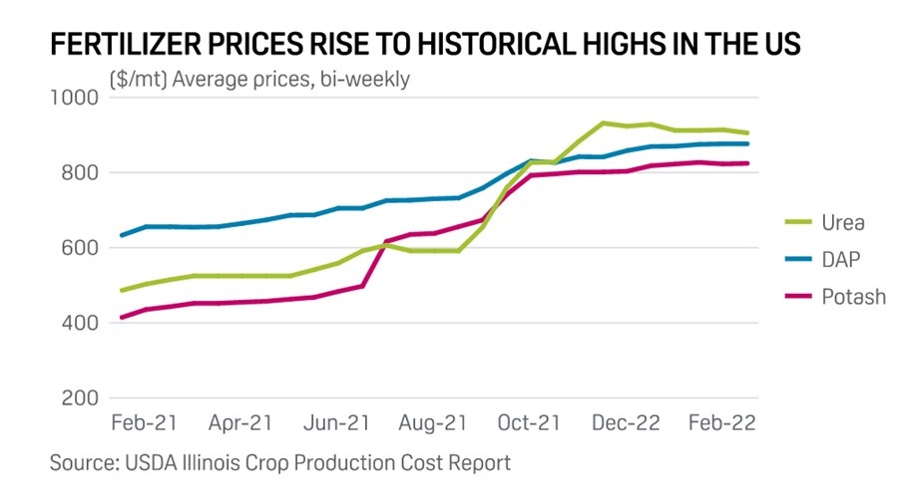

The soaring energy prices have also had a direct impact on the production of fertilizers, which is reflected in the finished product. Natural gas for instance, is a key ingredient in fertilizer manufacturing.

Without the use of fertilizers, agricultural production and food supply could only feed approximately half of the world's population. Unfortunately, the price for fertilizershassurged dramatically since 2020, with several escalating even by 300%.

Up until 2020, the estimated cost of a ton of fertilizer was 270 USD, compared to 1,400 USDthat it currently costs, resulting in additional costs that farmers are being forced to pass along to customers.

Chemicals, fertilizers, and seeds account for roughly 18% of farmers' budgets.Withoutfertilizers, crops may not be as nourished as they need to be, causing yields to dip.

Moreover, fertilizers are also required for the growth of industrialized crops. Fertilizer expenses are unquestionably a significant input cost for food. These costs will result in increased grocery prices.

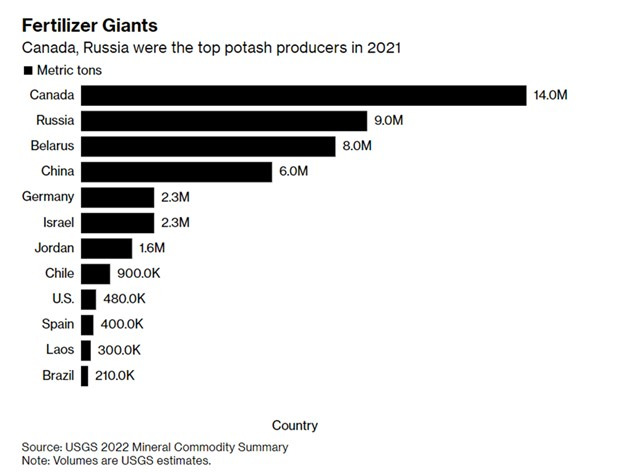

Another reason for inclined prices is the shortage of fertilizers. Russia and Ukraine combined export around 28% of the global production of fertilizers made form nitrogen, phosphorus, and potassium, whereas Russia and Belarus together roughly provide 40% of the world Potash exports. However, the war has disrupted shipping and sanctions on Russia and its allies have shortened their supply.

The impact of the war on FX markets, indices, and metals

Investors from around the globe have been watching closely and thoroughly the events that have been taking place between the two ex-Soviet Union countries. As it is, the Russo-Ukrainian war has thrown a lot of burden on FX markets, causing a lot of volatility.

Gold

Russia is among the world's leading countrieson natural resources. It holds between 25% and 40% of the world's unmined gold, is considered the fifth largest gold reserve, and the third largest gold producer. As a result, the sanctions on Russian gold exports affected the globalsupply of gold, leading to fast increase in the prices, sometimes even reaching a solid 2,000 USD for an ounce (back in March 2022).

Gold, also known as the "safe haven", has always been concidered as a low risk investment. Gold prices have shown a considerable increase in the last 10 years, making gold the most valuable metal: the one with low risk of losing its value, and the metal with increasing chances of returns to the investors’ money.

The yellow metal is expected, in the near future, to perform better against the US dollar and other currencies in the near future.

Indices

The United States and the European Union sided with Ukraine since the beginning of the war and declared sanctions on Russian exports, Russian individuals, and Russian businesses. However, unlikethe EU, the US economy was better protected and isolated from the effectsthat the war would bring. During the past six months,European indices have suffered their worst performance, amid the gas and oil shortage andskyrocketing prices due to the halt of Russian Nordstream 2 gas pipeline, and the repetitive cuts of Nordstream 1 by Russia. Thisresulted in increased inflation rates, pushing investors to exit indices markets in an effort to avoid high risk investments.

Future projections regarding indices have shown a higher likelihood for a continuous dip in prices. In fact, economic experts expect that American indices would lose between 26% and 30% of their value by the end of 2022. The same fears surround European indices which have been shedding in value. These forecasts originated amid fears of economies entering a state of recession.

Currencies

As soon as the Russo-Ukrainian war started, the Russian rouble received its first market slap.Rouble decreased in a dramatical pace days after the invasionagainst Ukraine, dropping to 138 roubles for every 1 USD, the highest drop recorded.The rouble dip happened after the announcement of a package of western sanctions,and the freezing of 60% of Russia's international reserve.

This urged Russia's central bank to respond with a set of new measures to save the falling currencies. Putin signed a special decree, binding all countries who clearly stated their opposition to the Russian state to pay for Russian gas in Russian roubles, identifying them as "unfriendly countries". Another contributor to the comeback of the rouble was the strong increase in the prices of oil and gas.However, the eurozone currency was the one mostly affected, reaching, in July 2022, a first time parity with the USD in 20 years, and then dropping below parity.

Because Europe strongly relies on Russian gas imports, the sanctions contributed in a market shortage, putting the "old continent" in risk of freezing winters. This led to a spike in eurozone inflation rates, along with the global food price increase.

On September 16, Russia's Central Bank lowered the key interest rates by 50bps, citing a slowdown in inflation rates. Hence, the Russian rouble is expected to perform better in the near future of its trading sessions now that USDRUB is trading higher than its initial pre-war levels.

On the contrary, the Euro is fighting to keep its value against foreign currencies; as warnings of a hard winter alarm the cold continent due to gas supply shortage and increased prices of electric bills that highly contributed in the rise of inflation rates. The ECB is now forcing a tight monetary policy by raising interest rates as an attempt to combat high prices and inflation rates. However continuous hikes in interest rates will cement the possibility of an economic recession that might strike the European continent, situating the euro in a roughhouse.

August 2022 Data and Future Forecasts

On September 2nd, the United Nations FAO released the relevant data for August 2022, stating that the world food price index fell to 138.0 points. The index has declined from a record high in March. This ease in the global food crisis came because of the newly signed agreement between Russia and Ukraine to resume grain exports through Ukrainian Ports.

Even though this agreement has impacted food prices and stopped its inclining trajectory, this alone cannot put an end to the ongoing price increases.

Governments will have to take secondary actions to suppress high inflation rates and economic recession which significantly impact on the prices of several commodities.

.png)