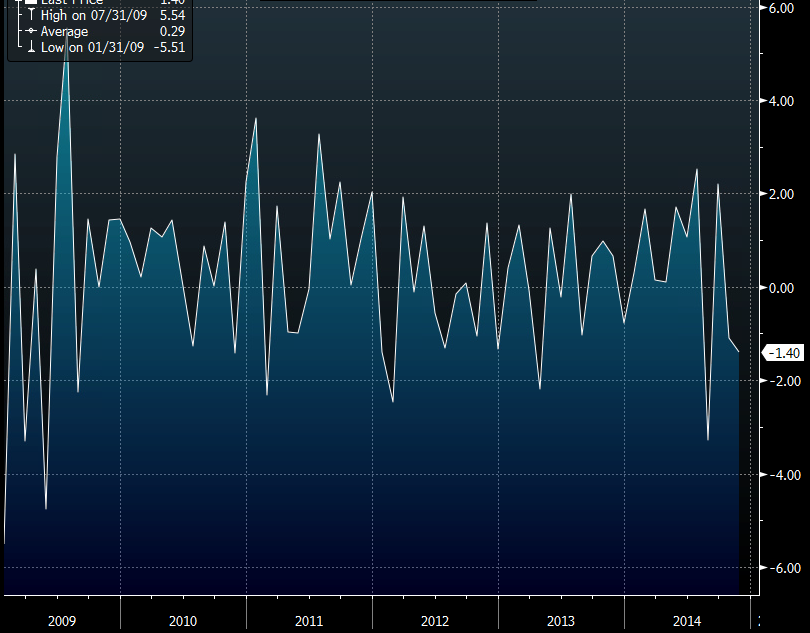

Highlights of the Canadian November manufacturing sales report from Statistics Canada:

- Prior was -0.6% (revised down to -1.1%)

- Statscan says report reflects “lower sales of motor vehicles, chemicals, primary metals and food

- Sales of motor vehicles fell 5.9%

- Unfilled orders edged up 0.2% in November to $91.1 billion, the fourth increase in five months

- New orders fell 1.7% in November as a result of a 6.2% drop in the transportation equipment industry

This is not a good report and is the third in the past four months to disappoint but there are some important caveats, especially the volatile auto sector. It’s a second-tier and dated report but it will be one of the last things the BOC sees and it’s given USD/CAD a 15-pip boost.

Canadian Nov manufacturing sales

At some point the soft Canadian dollar will be a boon to Canadian manufacturers, especially if the US economy begins to gather some momentum. The CAD focus at the moment is on tomorrow’s Bank of Canada decision. I see the risk that the BOC inserts a rate-cutting bias in a move that would undercut the loonie.

USD/CAD is 75 pips higher today as it unwinds the move yesterday that didn’t make any sense. I wrote about the potential for longs in the wrap yesterday:

USD/CAD was a tough one to understand as it slid lower despite falling oil prices. I have a hard time believing any moves in such a thin market and if you were looking for a nonsensical move to fade, that might be spot