The market has been bullying central banks again as of late, so will policymakers fight back this time around?

The key ones to look out for this week are the RBA, Fed, and BOE meetings. So, let's cut right to the chase, shall we?

RBA to push back against rate hike expectations?

The RBA lost control of the front-end last week by giving up yield curve control. The market is basically expecting them to put an end to the current policy and perhaps even drop the most important part of their guidance since the pandemic (in bold):

The Board is committed to maintaining highly supportive monetary conditions to achieve a return to full employment in Australia and inflation consistent with the target. It will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The central scenario for the economy is that this condition will not be met before 2024. Meeting this condition will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.

The market is signaling that the RBA hasn't got what it takes to be that patient. So, will policymakers counter that and outright call that the market is getting too ahead of itself when it comes to rate expectations?

Adding to that, will the RBA continue to rule out a rate hike next year and in 2023?

That will be one to watch come tomorrow.

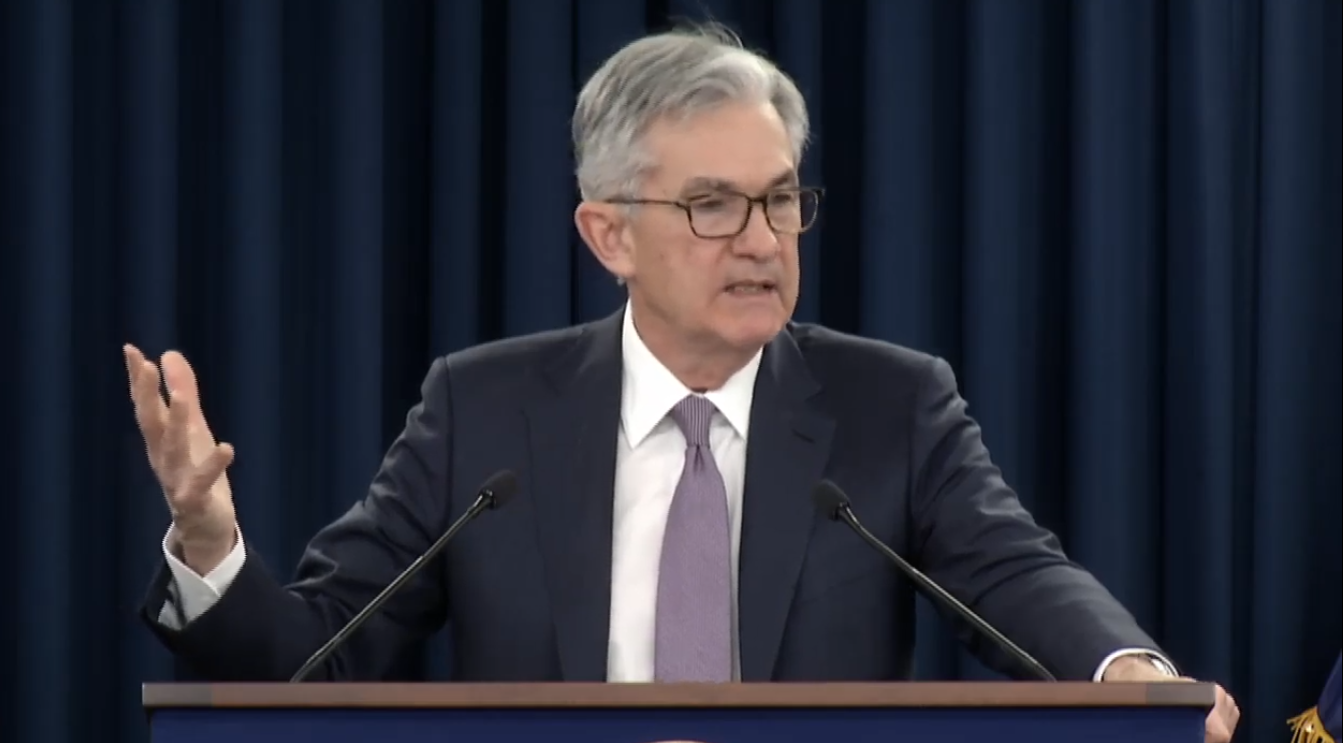

Fed to make clear that tapering does not mean rate hikes

I believe this one will be a bit more straightforward. However, the market reaction may not quite be as what the Fed may want it to be perhaps.

The recent flattening of the yield curve perhaps suggests something is awry with the financial outlook - one way or another - and even if the Fed plays its cards right, we may still see the trend continuing over the next few weeks.

The market is expecting a taper announcement by the Fed this week and they will surely deliver on that. The question then becomes how far are they willing to go to make clear that the taper process is not going to be correlated or isn't going to translate immediately to rate hikes going into next year.

In that lieu, I would expect the Fed to reaffirm that they can opt to delay or slow down the taper process depending on market conditions but that will largely be semantics.

At the end of the day, the Fed is familiar with all this bullying and so is the market. I reckon that might not change until policymakers offer up a firm voice on the matter.

BOE to start with rate hikes?

There is certainly the potential for that as UK inflation stays elevated and rising price pressures across the globe will only keep risks tilted to the upside.

The BOE is among the frontrunners in admitting that they may sooner rather than later hike rates so it wouldn't be the most surprising thing to see them begin this week.

The market is basically split on a 15 bps rate hike but in the event of any rate hike, expect the BOE to still adopt a dovish tone and outline that this is mainly to do with concerns surrounding the inflation outlook.

As such, it will constitute to a dovish hike if anything else and one that will be "gradual and limited" (their favourite wording) so as to not overdo it and risk a policy accident.