The White House economic advisor and candidate to lead the Fed misunderstood everything the SNB did

Trump's top economic policy advisor and the man who is crafting his tax plan doesn't understand the biggest event in the currency market in the past five years.

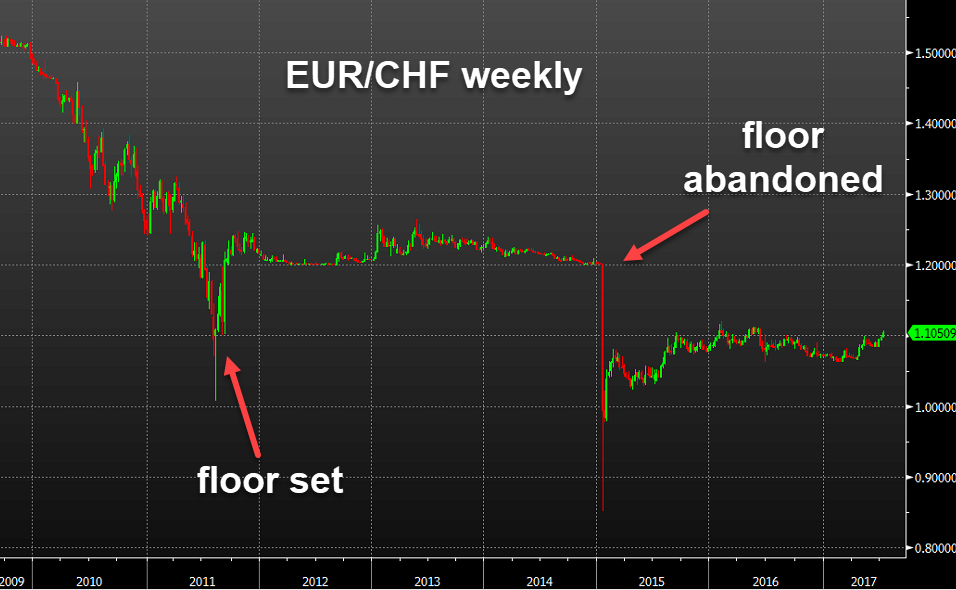

Gary Cohn thinks the Swiss were artificially inflating their currency until January 2015 when the EUR/CHF floor was removed. It was just the opposite.

"At the start of 2015 there were three countries in the world that were willing to have a strong currency. The Swiss, the Chinese, and the U.S. The Swiss pulled the rip cord overnight. They just ripped it off and said, 'We are done. We are done having a strong currency. It is too expensive to defend this," he told the WSJ late last year.

That's not a slip of the tongue, that's a fundamental misunderstanding of what happened.

In reality, the Swiss franc was trading at high levels as the eurozone crisis flared. So in September 2011, the Swiss National Bank devalued the currency by setting a floor of 1.20 in EUR/CHF. This was a direct devaluation of the franc.

His misunderstand (or inability to read a currency chart) is embarrassing enough for a top advisor to a President that made currency policy a central part of his plan; but what makes it worse is that Cohn was the #2 man at Goldman Sachs throughout the period of the franc peg. It was a massive event at the firm and throughout markets.