What is the impact of the Georgia runoff elections?

All eyes have been on the US state of Georgia for the runoff election yesterday. With the result still unknown, financial markets have been on edge anxiously awaiting results in what could have a large impact domestically.

The New Year started off with markets already in panic mode, having opened Monday in sell mode. Risk assets were the hardest hit as apprehension helped instill a bearish mood across numerous markets.

Conversely, precious metals and safe havens were the big winners early in the week. Gold and silver in particular are off to their best week in months as uncertainty continues to reign.

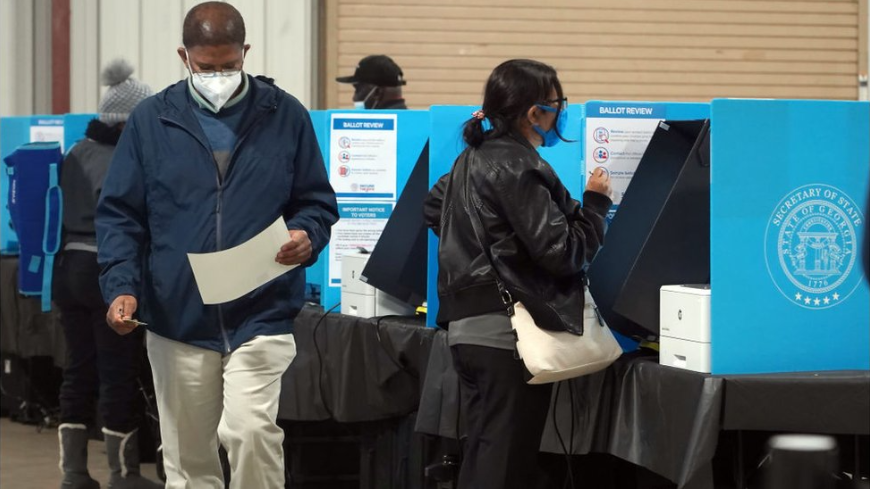

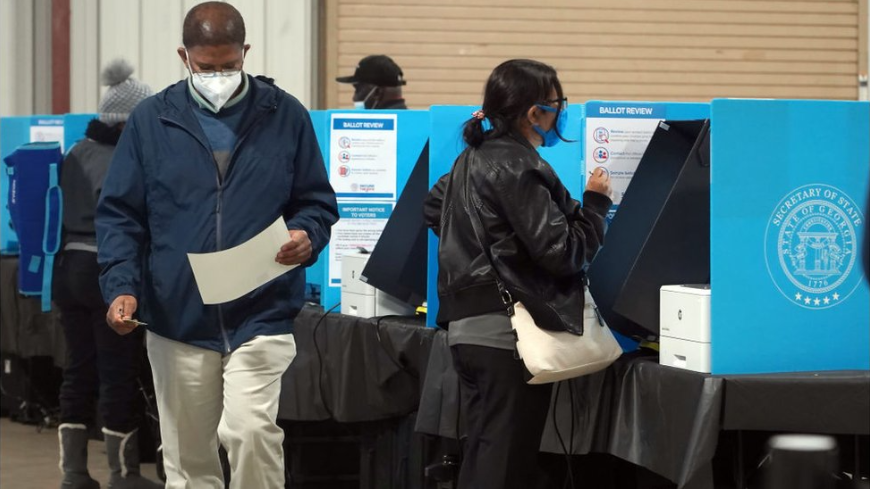

Georgia in Focus

The fate of the US Senate and by extension the potential to enact an entirely new and progressive agenda is firmly in play in Georgia.

With claims ranging from $2,000 stimulus checks to sweeping progressive proposals, both US political parties have a ton on the line.

A recurring trend of US elections in 2020 was ambiguity and delayed results. The two runoff elections Tuesday were no exception, as all candidates are waiting and seeing the final tally that will define markets in Q1 2021.

On one hand, analysts expect a larger sell-off if Democrats win both seats Georgia and secure the Senate for the next two years.

However, this outcome could also represent an opportunity for a bigger and faster spending package. Such a package could be a huge net positive for US markets.

Wall Street is expecting at least one or both Republicans to win seats, which would prevent a Senate majority. This is the outcome that is most likely based on polling margins.

In this scenario, markets will not have to grapple with the unknown, having already endured several years of a Republican-held Senate.

This would also pave the way for a move higher in financial markets, with the single biggest unknown risk factor dealt with.

Look for any updates or a break in the race one way or the other to have a strong and seismic impact on markets.

With the contour of the race so close and the stakes so high, the runoff elections may not be called for several days, leaving financial markets in limbo.

Covid Still in Focus

It's impossible to distill the impact of Covid from financial markets outlooks in Q1 2021. Early projections of a rapid dispersal of Covid vaccines have clearly fallen short of expectations.

Meanwhile, cases have spiked and continued to worsen with the onset and passage of holidays in the Western world.

Any sustained spikes or deaths across Western European countries or the US could put a near-term damper on market optimism.

With positive vaccine news already baked into most projections, it's up to global health agencies or authorities to stay on schedule with distributing the vaccine.

Any delays or setbacks are likely to result in abrupt, albeit temporary selloffs with expectations of a turnaround expected by the second half of the year.

This article was submitted by CMS Prime.