Everything is changing

The under-the-rader theme of 2020 is how so many correlations are breaking down. There's risk aversion today but USD gains since the height of the worries today are nearly erased.

I wrote earlier about how the bond market move has been counterintuitive.

There are different parts of the ebb-and-flow that you could point to for this but it follows other patterns that have been breaking down all year.

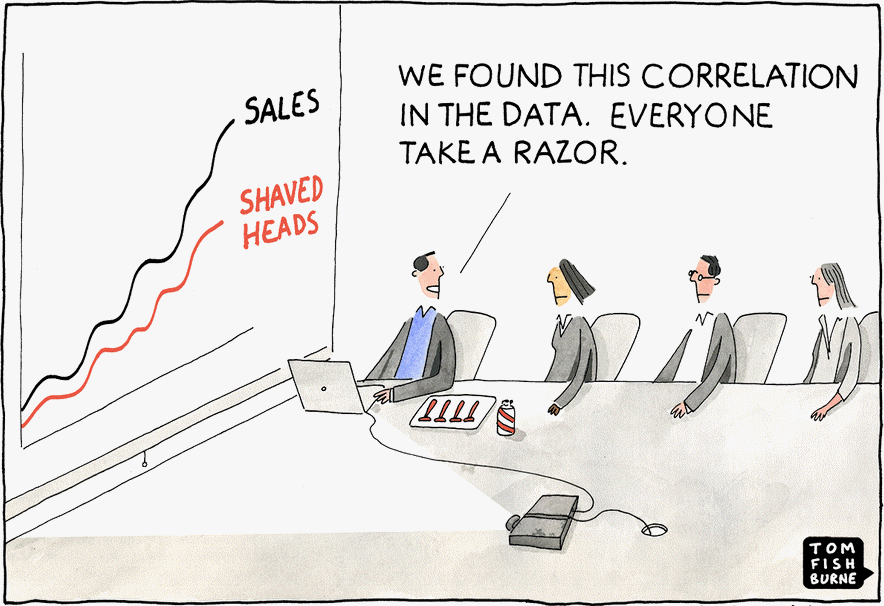

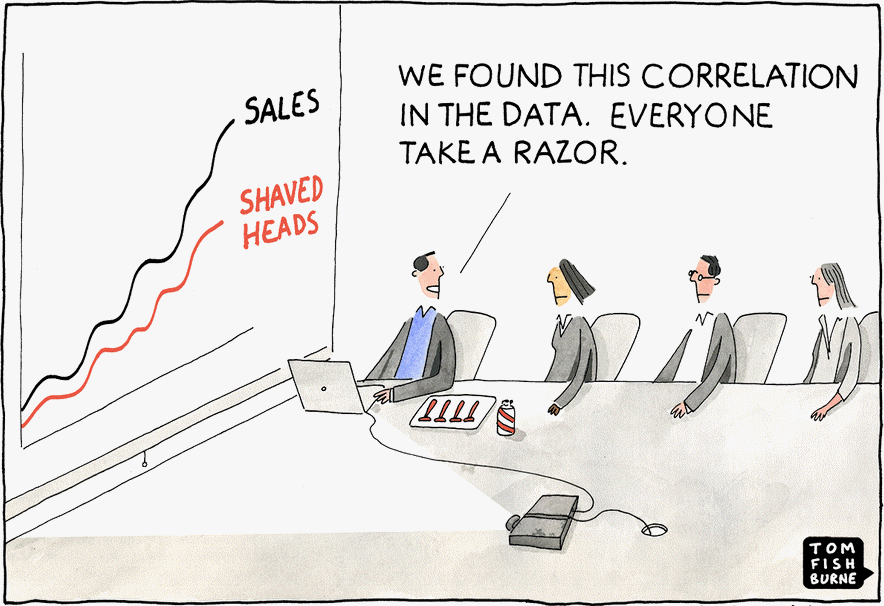

I've been grappling with the belief that markets change for months; that correlations change; that how markets respond to news changes. Roughly every decade it changes and here we are in 2020. The risk-on/risk-off paradigm is shifting.

That makes answers even harder on a day-to-day basis but the people who solve this riddle are going to be at the front of the line in making money on it. These are still early days but I think keeping an open mind is better than making a few pips in the short term.

Today, the euro is back to flat after a rout on risk assets and the Australian dollar is higher. The Canadian dollar is at a session high with oil down 4.6% to compound everything.