The investigations into forex interbank trading continues

Now we have the news that banks, and therefore the authorities, are now wising up to the fact that option expiries and barriers are being manipulated too.

We’ve naturally been reporting on this for a while and back in October I warned of a witch hunt. I have since warned that, as a market, we should be taking this stance by the regulatory authorities and the desire of banks to wash its stained hands as a very serious and far-reaching investigation. The massive growth in the forex market has failed dramatically to previously attract such attention from the regulators and now they seem keen to make up for lost time.

In all, about 20 traders and bankers including some in New York, London and Tokyo have now been suspended or fired. In addition, several senior currency trading related bank personnel have recently retired or resigned from their positions.

It’s a fine line, I believe, between info flow and insider trading or manipulation. In my day it was an accepted practice to share information about bids, offers and general flow with traders outside my own room but never divulge the client name. And that is how we at ForexLive and others come to publish our orderboards each day as a lot of that info is now in the public domain anyhow, in addition to what other snippets we manage to glean.

News agencies too have never been shy of getting reporters to garner information from their interbank contacts, and must accept their own share of responsibility.

But be warned that should the authorities tighten up then such information will be contained within the interbank market far more, and indeed each bank, for fear of now knowingly breaking any new or existing laws, and that will impact on what we can report here. That means the retail sector will have even less access to information on flows and order levels. Many of you dismiss orderboards and flow as secondary to your chart or software signals but it’s naive to think that the two areas are in any way separate from each other. Charting is after all based on flow history, and there’s plenty of that in forex.

As for manipulation, yes, in my day I made a few “actions” to hunt out the weak side in the flows of intra-day trading but that was all part of the process and was aimed to of course make money but hurt my competitors too if at all possible, but not my clients. And yes sometimes I came well and truly second if I picked the wrong side! With over 97% of the now USD 5.3 trillion daily turnover being speculation these actions were/are based both on fundamentals, technical analysis, and in my case more than a large dose of gut feeling. I should stress here ( before the authorities disturb my now rural tranquility and bash the door down) that these actions were in the course of the day’s trading and never involved with the fixing times.

Is human-led intervention any more sinister or guilty of malpractice than the current massive growth in algo boxes and programmed trades? I’ll let you the jury decide that one.

So we should be concerned with what’s going on out there right now. Many here in the various related threads have been cynical about the impact that any such actions by certain interbank/institutional traders can have on the fixings , options and orderboards. But given the right market conditions ( price, volatility/liquidity,trend) there is no doubt that they do.

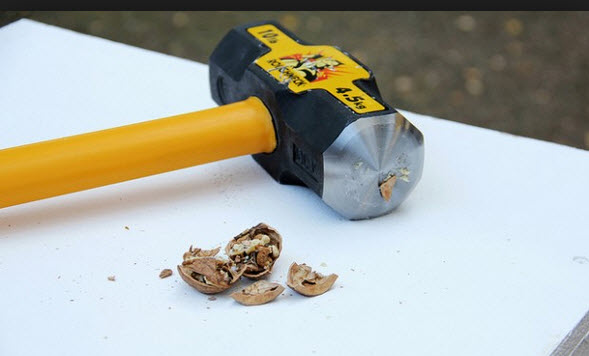

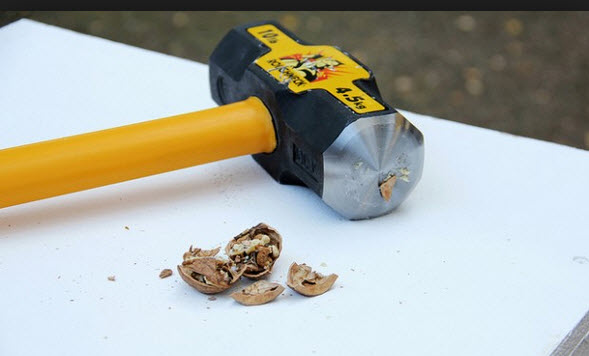

The real danger I see is that the regulatory authorities and the banks will take a wrecking ball to crush a nut and the blanket crackdown will have far reaching impact on market flows and our ability to report them.

Let’s hope I’m wrong eh?