The latest from ANZ on gold. Their comments on 'safe haven' buying are unsurprising, but even without this factor they still like gold.

In Summary:

- Safe haven buying has provided strong support to gold prices over the past six months. However rising geopolitical risks in the US and elsewhere are likely to propel prices even higher, despite the spectre of a rate hike in the US next month. We see gold holding above USD1250/oz in the short term, and an increasingly possibility of it breaking through USD1300/oz this year if the political situation in the US worsens.

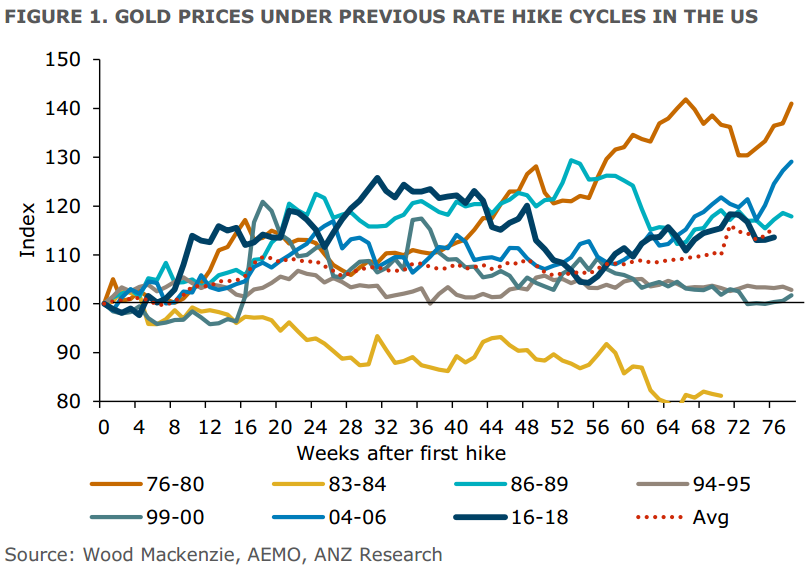

- Even without the support of safe haven buying, we still see an environment conducive to higher gold prices. Much has been debated about the impact of rising US interest rates on gold. However, we don't see this as a hindrance over the next 12 months. In fact, over the past seven rate hikes cycles (going back to the 1970s), gold has pushed higher in all but one case. Moreover, gold has outperformed in the cycles where interest rates were increasing relatively slowly

- We are also seeing signs of an improvement in the physical market. While coming from a low base, physical demand in India and China have rebounded sharply in recent months. The issues around demonetisation in India appear to be abating, while a sharp pickup in gold imports into China suggest previous constraints have also eased