This is a National Australia Bank survey. The bank conducts a monthly survey and also this quarterly survey. The two are different but the monthly is the focus.

From today's results:

Highlights from NAB (in very brief):

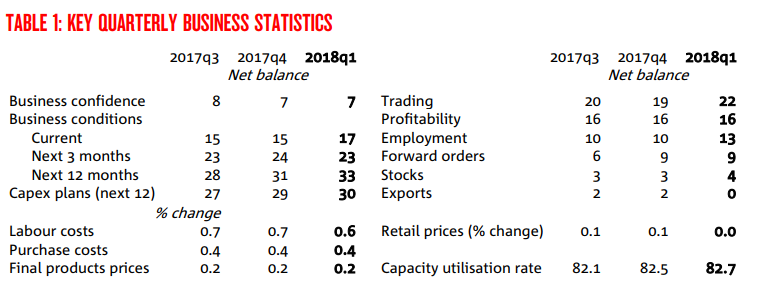

Business conditions (an average of trading conditions/sales, profitability and employment) increased by 2pts to +17, its highest level since 2007, although the monthly survey indicates conditions, while still strong, eased late in the quarter.

- gains in trading conditions and employment,

- profitability was unchanged

- all three components are well above their historical average

- conditions were positive in all industries and were also at, or above, their long-run average

- Conditions were strongest in construction

- retail continues to lag the other sectors. However, retail business conditions improved again in the quarter and they are now at their highest level since 2015 Q4

Business confidence was unchanged at +7 and it has been relatively stable since 2016 Q3, staying within a range of 6 to 8 pts, a little above its historical average of +5.

Overall, leading indicators continue to look positive, although there was some easing in expectations for the next three months

Labour indicators point to a tightening labour market

- While there is no upwards move yet in wage growth the conditions are in place for this to occur

- employment and employment expectation indicators are at their highest level since prior to the GFC

- more firms indicated that difficulty in finding suitable labour is a major constraint on output -

Survey inflation indicators remained subdued although expectations for next quarter's final product price growth moved higher and are consistent with a gradual rise in core inflation

-

This as background from NAB's preview:

- An alternative perspective on the degree of spare capacity in the labour market comes with the quarterly version of the NAB Business Survey, on Thursday. Businesses are asked to report on the constraints that are limiting their growth, including the "difficulty of finding suitable labour" that's been becoming more prominent of late and at levels not seen since the GFC. The quarterly survey has also for some time been pointing to a pick-up in non-mining capex, a trend that has become prominent in the Statistician's Capex survey for the past year or so and increasingly a source of economic growth.