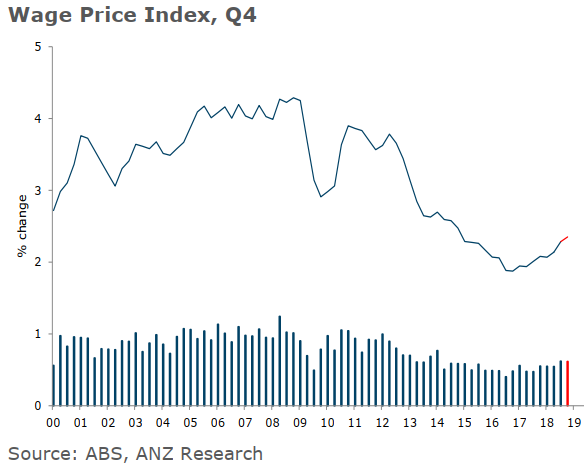

Wages growth has been on a slowly improving trend. Slack in the labour market,

(underemployment persists) alongside inflation, and inflation expectations, being subdued are factors.

A couple of bank previews:

ANZ

- We are expecting a 0.6% q/q rise in the WPI in Q4. This would be in line with the 0.6% q/q gain in Q3, and suggests some residual impact from the hike in the minimum wage which came into effect on 1 July. A 0.6% q/q rise would see annual growth edge up to 2.4%

Graph via ANZ:

Westpac:

On the previous release:

- Total hourly wages ex bonuses increased 0.6% in Q3, in line with market and Westpac expectations, lifting the annual rate to 2.3%yr from 2.1%yr. Private sector wages grew 0.5% holding the annual rate at 2.1%. Public sector wages grew 0.6% lifting the annual pace to 2.5%yr from 2.4%yr. Public sector wage inflation had been flat at 2.4%yr since Q1 2017.

For today's release and further ahead:

- The labour market clearly tightened through 2018. Unemployment fell from a Q1 average of 5.5% to a Q4 average of 5.0%. This has led to a tightening of labour market conditions with firms reporting it is getting harder to find suitable labour. There has even been a trend improvement (decline) in underemployment.

- Along with the boost to the minimum wage it is clear that wage inflation has found a base and it is likely to lift modestly from here.