Its Q1 (January - March) CPI from Australia coming up, headline and two core (underlying inflation) results.

Due at 0130 GMT on 24 April 2018

For the 'headline'

- expected is +0.5% q/q

- prior was +0.6%

- For the y/y, expected is 2.0%, prior 1.9%

For the 'trimmed mean' (which is the measure the RBA pays most heed to - its the 'core' inflation figure where the RBA target band is 2 -3%)

- expected 0.5%

- prior 0.4% q/q

- y/y, expected is 1.8%, prior 1.8%

Finally, there is the 'weighted median', also a core measure:

- expected 0.5%, prior was 0.4%

- y/y, expected 1.9%, prior was 2.0%

I have already posted previews of this:

- Heads up for AUD traders - Australian CPI data for Q1 - preview

- What will guide AUD/USD this week (event risk for the Australian dollar)

- Australian Q1 inflation data due this week - preview

More now, this via Westpac:

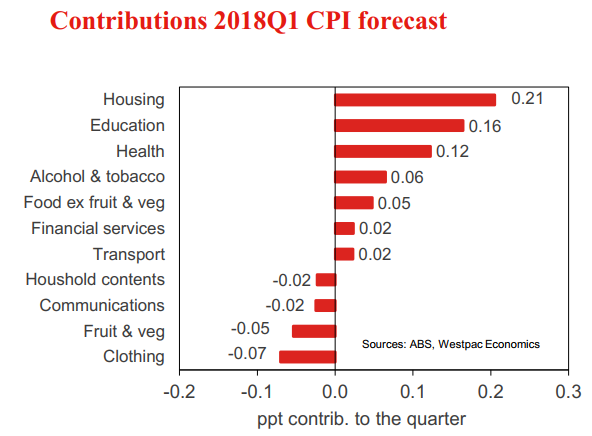

Westpac's forecast for the headline CPI is 0.5%qtr holding the annual pace flat at 1.9%yr.

- Core inflation is also forecast to print 0.5%qtr (0.50% at two decimal places) holding the annual pace flat at 1.9%yr.

In the March quarter the increasing perseverance of post Christmas sales now overwhelms an historical seasonal uplift associated with the re-pricing of administrated prices and the resetting of the Pharmaceutical Benefits Scheme. The ABS estimates a seasonal factor of slightly more than -0.1ppt.

Core inflation remains below the bottom of the RBA target band and with the expected moderation in dwelling purchases price inflation through 2018, along with consumer goods still captive to a competitive deflationary cycle, it is hard to see core inflation breaking much higher

Nomura:

We forecast a 0.6% q-o-q rise in headline CPI inflation in Q1 2018, which would see year-end inflation rise to 2.1% y-o-y from 1.9%.

- We expect headline CPI inflation to be pushed up by higher tobacco and electricity prices, a 1% rise in fuel prices, and seasonal rises in health and education costs.

Core inflation should be relatively more contained, and should provide evidence of subdued retail price pressures - we forecast the trimmed-mean measure to rise by 0.48% q-o-q and by 1.8% y-o-y.