An earlier preview of the wages data for the July to September quarter is here

The folks at ANZ:

- We look for a 0.7% q/q rise in the WPI in Q3. This would be a step up from the 0.5% q/q average gain over the past three years and the highest quarterly gain since March 2014. It would see annual growth in wages rise to 2.4%. While ongoing tighter labour market conditions will be supportive, the main drivers of strength will be the 3.5% lift in the minimum wage.

Westpac:

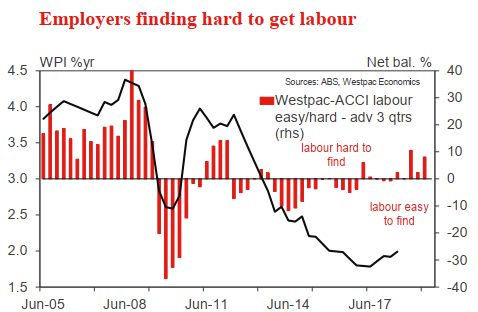

- There has been some removal of excess slack in the labour market, as measured by falling unemployment and modest declines in broader measures of labour market utilisation. In the last year there was also the larger than usual boost from the annual lift in the minimum wage. And yet we are still waiting for a meaningful pickup in wage inflation.

- Total hourly wages ex bonuses increased 0.6% in Q2, in line with market and Westpac expectations; lifting the annual rate to 2.1%yr from 2.0%yr (was 2.1%yr). Private sector wages grew 0.5% lifting the annual rate slightly to 2.1%yr. Public sector wages grew 0.6% holding the annual rate at 2.4%yr - a pace maintained since 2017 Q1.

- This year the lift in the minimum wage was 3.5%yr, a small increase on the 3.3%yr granted in 2017. However, in 2017 the minimum wage increase did not have a meaningful impact on aggregate wages. Will we see a larger impact in 2018?