Preview of Australian Q3 Wage Price Index, due at 0030 GMT on Wednesday 14 November 2018

- expected +0.6% q/q, prior was +0.6% also

- expected 2.3% y/y, prior was +2.1%

Preview via RBC:

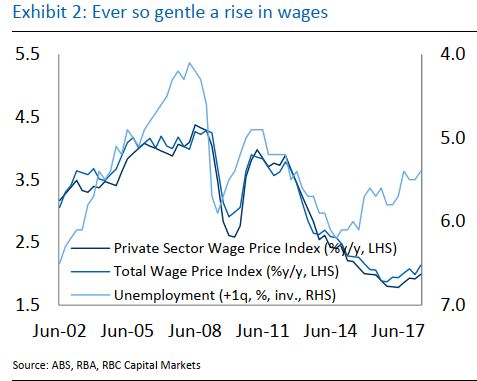

- Annual wages growth has lifted from its lows but momentum has been modest, consistent with ongoing slack in the labour market, with y/y running a little above 2%. We expect the 3.3% rise in the minimum wage, effective 1 July, to have boosted the WPI in Q3 and we look for a 0.7% rise in the quarter.

- Helped by some base effect, this would lift y/y wages growth to 2.4%, its fastest pace since end 2014. However, we do not expect this momentum to continue, with wages growth likely to revert to a 0.5/0.6 quarterly pace, taking annual growth back toward 2¼%.

National Australia Bank:

- markets will be looking for signs whether wages growth is gathering momentum

- given the large minimum wage (MW) increase this year, and anecdotal evidence of higher pay, we expect a 0.6% q/q rise, with some slight upside risk.

- we are cautious in not expecting too much of a MW boost to Q3 wages

- While the Fair Work Commission's MW decision of a 3.5% increase was 0.2ppt higher than the 2017 decision of 3.3%, the 2017 decision was 0.8 to 0.9ppt higher than the previous two years, but with little additional impact on Q3 wages. Instead Q4 wages seemed to be boosted a touch (by 0.1ppt). Hence we expect only a modest MW effect on wages growth.

- Note, while only 2% of employees are on the minimum wage, 23% of employees are affected by the increase due to Australia's system of award agreements. Beyond Q3, we are encouraged by the tighter labour market, as evidenced by the lower unemployment rate, and leading indicators that suggest further wages pressures ahead. In particular, the NAB Survey has shown firms are reporting increased difficulty finding suitable labour and high levels of capacity utilisation.

--

ps. The Australian employment report for October due Thursday is another big focus this week