Parliament shuts down, now what?

British Parliament has officially been prorogued (or

suspended) until October 14. That means that there are no debates, nor votes held.

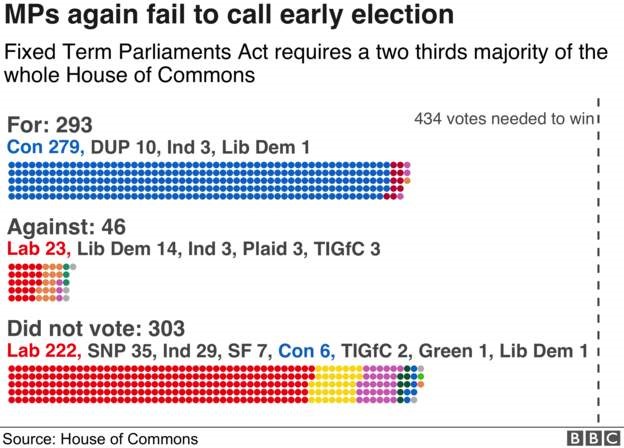

In yesterday's final House of Commons' session, MPs voted against the motion from the

government to call a snap election.

There is a lot of market noise on currency pairs linked to the GBP, especially the GBP/EUR and the GBP/USD. There is also a certain amount of market volatility, as what's going to happen next with Brexit isn't clear.

The GBP/USD bounced back from its 3-year low, which weighs on the main British index

While the GBP/USD pair lost up to 6% since Boris Johnson's appointment, the currency pair recently bounced back on its lowest level since October 2016 to trade around 1.2330 at the time of writing. As strong U.K. growth figures have recently been published, the pound has strengthened against other currencies. After the prorogation announcement the pound fell.

Many analysts expect the currency pair to keep declining, despite recent spikes, because of several major geopolitical considerations. These include mounting concerns over Prime Minister Boris Johnson's tenure as head of government, the parliament suspension, the passage of Brexit legislation by October 31, 2019, and the ongoing uncertainty vis-a-vis the potential for a US trade war with the European Union.

Financial analysts have reiterated concerns on the falling purchasing power of the pound. Speculative net positions, including online exchange brokers such as Easy Markets on the GBP are strongly negative over 1 year, 2 years, and 5-year projections. Immediately prior to Brexit in 2016, the GBP/USD pair was hovering around 1.50. Since then, approximately 20% of the GBPs purchasing power has been erased, with significant downward momentum on the cards.

The relationship between British indices and the GBP/USD

As about 70% of the components of the FTSE 100 index are exporting companies, most of their revenues are coming from abroad. Therefore, a weaker GBP is positive for these companies, as it means that the purchasing power of foreign buyers of UK goods and services is higher.

On the other hand, a stronger GBP weakens the export-driven growth of UK-listed companies on the FTSE 100 index. The 2019 performance of the GBP/USD pair is bearish, and this dovetails with strongly positive returns on the FTSE 100. Some 2/3 of revenues generated on the FTSE 100 index are derived from foreign earnings.

That's the reason why a weak GBP benefits the bourse. The FTSE 250 index is made up of all UK-based companies, and a weak GBP exposes this index to poor performance. As foreign-based companies repatriate their profits to the UK, the returns are worth substantially more in GBP. A weak sterling can increase share prices on the FTSE 100.

As you can see in the above chart, the FTSE index and the GBP/USD currency pair are negatively correlated, as they (mostly) evolve in opposite directions.

More twists and turns over Brexit expected

The question on every investor's mind remains about the October 31st 2019 deadline for Brexit - Is it doable?

Most pundits tend to think not. The prospect of a negotiated settlement is growing slimmer by the day. With just over a month until the PMs deadline expires and with the Parliament being suspended, it is unlikely that the 'Irish backstop' idea will be scrapped by the EU.

A surprise Brexit deal could take markets completely by surprise and make the pound a highly attractive prospect.