German ZEW survey on the agenda but Yellen's testimony remains a key focus later in North American trading

It is shaping up to be turnaround Tuesday as the dollar and yen eases across the board, in anticipation of the return of US traders and Wall Street from the long weekend.

10-year Treasury yields are up by nearly 3 bps to 1.112% and that is underpinning yen pairs across the board while a more risk-on mood in the equities space is pushing both the dollar and yen lower as we look towards European trading.

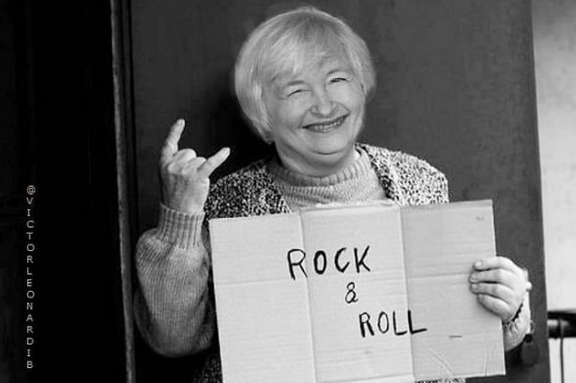

Cautious positioning going into the long weekend was a plausible factor behind the latest breather in the market, but investors appear excited to get back into the thick of things awaiting comments by Treasury secretary nominee, Janet Yellen.

S&P 500 futures are up 0.7% on the day currently.

Looking ahead, economic data in Europe will continue to take a backseat as the market goes through the motion of the "real" start to the new week before getting to Yellen.

0700 GMT - Germany December final CPI figures

The preliminary report can be found here. As this is the final release, it shouldn't do much besides reaffirming more subdued inflation towards the end of last year.

0730 GMT - Switzerland December producer and import prices

Prior release can be found here. A gauge of price pressures in the Swiss economy, which should reaffirm more subdued conditions overall. A minor data point.

0900 GMT - Eurozone November current account balance

Prior release can be found here. General indication of flows in/out of the euro area economy, which continues to keep below pre-virus levels.

1000 GMT - Eurozone November construction output data

Prior release can be found here. An indication of construction activity in the euro area. A lagging data point as the market no longer is focused on Q4 data.

1000 GMT - Germany January ZEW survey current situation, expectations

Prior release can be found here. There is going to be two parts to the report, with the current situation index set to slump further to start the new year amid tighter and prolonged restrictions in Germany. However, expectations are estimated to jump higher still amid vaccine optimism and hope of a return to normal by the summer perhaps.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.