Keeps distance from 100 day MA

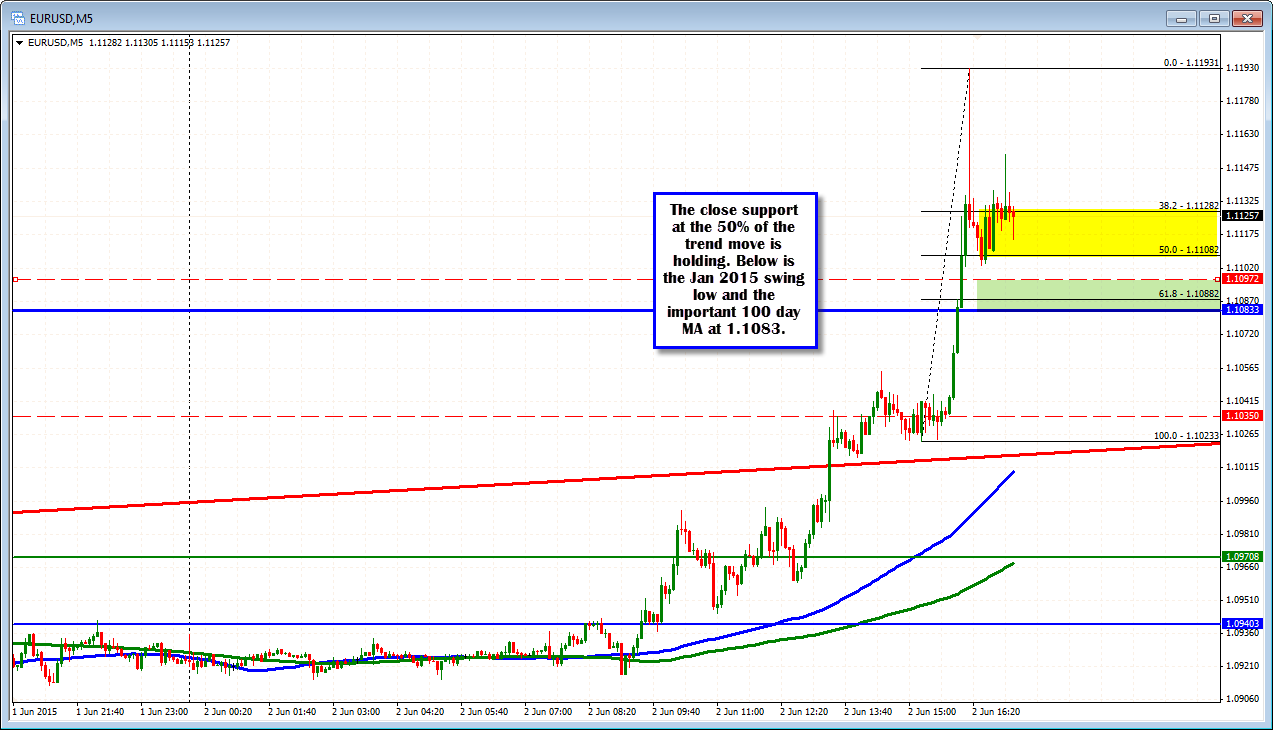

The EURUSDs trend leg higher from 1.1023 to 1.1193 has as the midpoint the 1.1008 level (see prior post). When the market trends, the market tends to find support in the 38.2-50% area. The EURUSD has found support buyers in this area (the low reached 1.1004).

The US factory order data was not great the IBD TIPP economic optimism was also not better than expectations. So EURUSD sellers are not getting love from US fundamentals. The high - post economic news - moved up to the 1.1154 level. The price is back down to 1.1123. There seems to be more two way action, but overall, the buyers still hold most of the control.

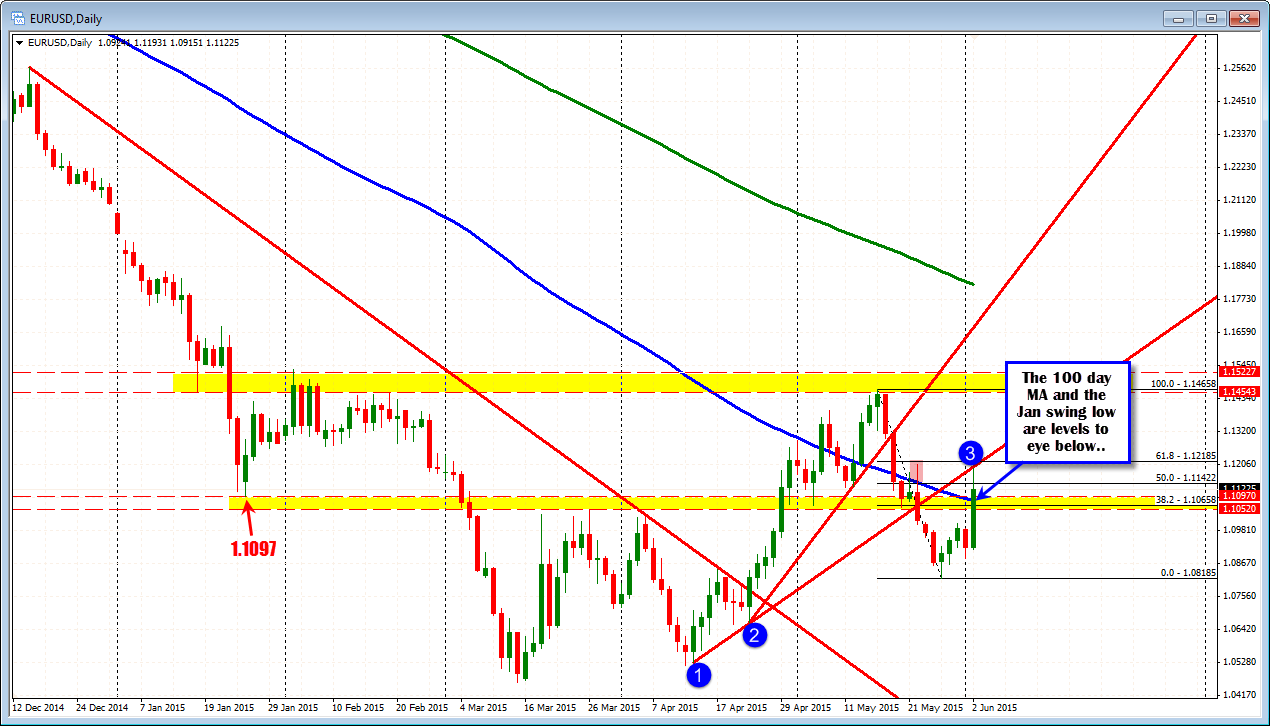

Should the EURUSD be able to move below the 1.1108 level, the market traders will then have the 1.1097 swing low from January and thn the 100 day MA at the 1.1083 levels to contend with. Given the way the price ripped through these levels with little in the way of any respect (unusual), I would expect that traders who may have sold against on the way higher, might be happy to get out of jail free on the first test. There will always be another trade if it can break back below the key level on Greek pessimism (i.e. traders stops below the level). Right now that is not the case....The buyers are holding the trump card and so far, they keep it in their hand.