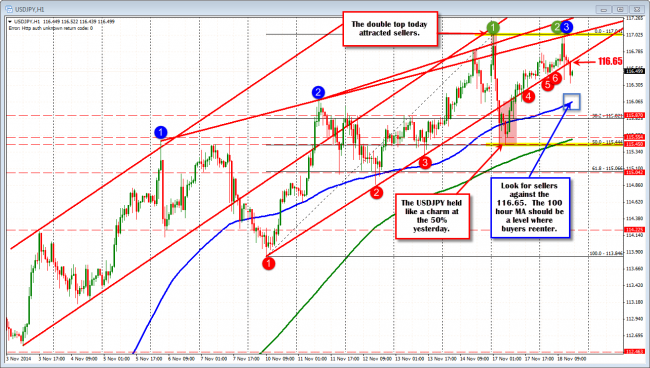

The worst kept secret was let out of the bag with the postponement of the sales tax until 2017 and the call for an election. The USDJPY rallied in respect, but found willing sellers against the high from yesterday at the 117.04 area (the high reached 117.03). The subsequent fall took the price below the “old” trend line support (the price corrected below this line yesterday but rallied and reestablished the line one last time). Being below the line should put the “sell the fact” sellers looking to lean against the line (at 116.65 currently).

USDJPY has broken below the trend line support at 116.65. If the price stays below a move toward the 100 hour MA will be eyed.

Stay below the 116.65 level and the 100 hour MA at 116.03, the 38.2% of the move up from November 10 at 115.82 and the 200 hour MA (green line) and 50% of the same move higher at the 115.44-528 are the support targets, but they should be increasingly hard to get to and through.

Relatively speaking the US is still > Japan. However, the pair looks like it may be more tired at the 117.00 area. Nevertheless, it is important to keep the risk levels in mind just in case the fundamentals reassert control before the technical correction can gather any momentum to a buy zone below (like the 100 hour MA). Look for patient sellers today against the 116.65 level and if it can get to the 100 hour MA (blue line) I would be tempted to buy on the first test. The range for the day would be near 100 pips and that seems good enough for me.