Forex news March 26, 2015 US edition:

- Yellen: Rate rise may well be warranted later this year

- Yellen points to jobs market over inflation as key metric

- Q4 2014 US GDP final 2.2% vs 2.4% exp q/q ann

- US corporate profits down -1.4%. Lower than expectations.

- U Michigan consumer sentiment final rev 93.0 vs 92.0 exp

- Rumor circulate about Greek capital controls

- Greek minister refuses to give assurances about IMF payment

- Greece will be finalising reform list over the weekend

- Baker Hughes US rig count 1048 vs 1069 prior

- CFTC Commitments of Traders: Euro shorts hit record

- Fitch downgrades Greece to CCC from B

- Canada still on track for budget surplus

- Germany's Schaeuble says EU governments need to implement structural reforms

- S&P 500 up 5 points to 2061

- Gold down $6 to 1199

- WTI crude down $2.40 to $48.87

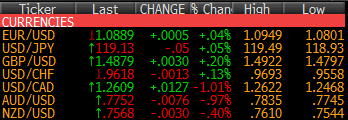

- NZD leads, EUR lags

Once in awhile central bankers deliver a bombshell but 90% of the time you spend the entire day waiting for a speech and it falls flat. Friday was one of those days as Yellen talked about data watching shortly before the close.

Oil and commodities were the big story in NY trading. Crude fell more than 6% at the lows and the loonie tumbled with it. USD/CAD jumped to 1.2608 from 1.2475 at the lows with the entire move happening in US trading.

The loonie wasn't alone as its commodity cousin in Australian also took a beating and finished on the lows at 0.7743 from 0.7800 at the start of US trading. Commodities are being sold ahead of quarter end because it's been a rough three months for everything but gasoline.

EUR/USD sagged in Europe but bounced back in USD trading. The big move was a squeeze higher to 1.0950 from 1.0875. It might have been stops on the break of 1.0900. The move was at the same time as the Greek rumors and left traders scratching their heads. Turns out the right move was to fade it.

USD/JPY was at 119.20 as NY started and dipped below 119.00 for a period and then bounced back up. Not too much to say in a choppy trade. Yellen added a few pips but not for long.

Have a great weekend.