Forex and Bitcoin news for Asia trading Friday 20 April 2018

- China's Ambassador to US says that if US initiates trade war, China will retaliate

- Brexit divorce bill will surpass £39bn, warns UK audit office

- Another overnight note on the AUD - "may stay in demand, at least in the short-term"

- Japan finance minister Aso says G20 imbalances must not be fixed by FX adjustment

- China commerce ministry to extend anti-dumping measures

- Morgan Stanley on AUD/USD - maintain strategic short

- More on the CHF comments from Swiss National Bank President Thomas Jordan

- 5 US sorghum vessels bound for China hit by tariff impact - 'U-turn"

- Japan March CPI data: Headline clocks in at 1.1% y/y (expected 1.1%)

- Japan Manufacturers (Reuters Tankan) index 21 in April - drops from 28 in March

- Fed's Mester: Further rate hikes appropriate this year and next

- US Treasury considering ways to restrict Chinese investments in the US

Forex movements in Asia today quietened down after the overnight moves, but some extensions nevertheless.

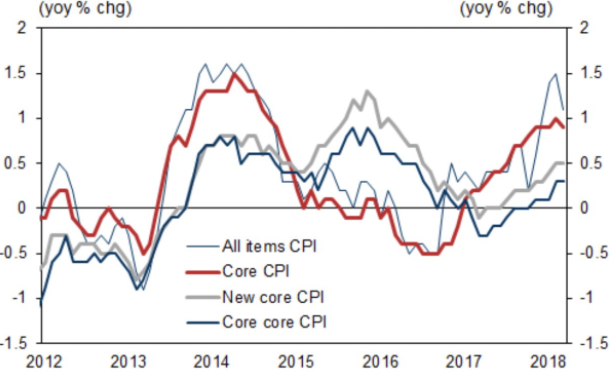

USD/JPY traded up, popping above 107.70 for a 30-odd point gain on the session. We got Japanese March inflation data today and while the currency move did not seem to be in response to the data release (inflation still way below target) the argument can be made that the data was a clear yen negative - there is no sign from the CPI of an early BOJ exit from easy policy. This graph of CPI is via Goldman Sachs, they are being generous perhaps by even putting 2% (the target) on the scale:

Apart from the Japan data news flow was very light indeed - further indications of trade tensions still bubbling away (see bullets above).

AUD and NZD both extended a little lower against the USD following their overnight slide. Cable fell hard overnight but sat in pretty much a range here today. EUR/USD also in a smallish range while the CHF lost a few pips against the USD during the session here. SNB Chair Jordan was interviewed on Bloomberg TV and he is not trying to out the brakes on CHF depreciation (again, bullets above)

Still to come today:

- Forex option expiries for today, Friday 20 April 2018

- CAD traders - inflation and retail sales data due today - preview

- CAD traders - inflation and retail sales data due today - more previews

To come next week: