Forex news for the European morning trading session 27 Sept 2017

News:

- Russia says it will retaliate against US restrictions related to open skies treaty

- UK says US decision to impose anti-subsidy duties on Bombardier's C Series jets is disappointing

- Moscovici says window of opportunity has opened for Europe

- South Korea in talks with China on bilateral currency swap

- Chinese bitcoin exchange BTCChina stops accepting deposits

- RBI to keep rates on hold in October and through next year but cut growth forecast

- GBPUSD pops 1.3400 as the retreat continues

- Australia - Gas companies agree to meet demand - no export restrictions

- Trading ideas for the European session

- Nikkei 225 closes down -0.31% at 20,267.05

- ForexLive Asia FX news wrap: Hopes are up for taxes down

Data:

- UK CBI Oct retail sales expectations 23 vs 19 prev

- France Sept consumer confidence 101 vs 103 exp

- Switzerland UBS August consumption indicator 1.53 vs 1.46 prev

- Japan August machine tool orders final 36.2% vs 36.3% prev

It's been a session that's seen further USD demand but it's not been the only story in town.

USDJPY has made good progress from 112.40 to test 113.00 and USDCHF similarly has rallied to post 0.9765 from 0.9700 with EURCHF steady around 1.1440 having drawn a new line in the sand of its own at 1.1420. USD sellers have emerged though in the latter part of the session to take some money of the table.

USDCHF 15m

EURCHF 15m

Indeed it's been a mixed day all round for the euro with EURUSD slipping further from 1.1790 to late-August levels around 1.1730-35 while EURGBP made early advances from 0.8770 to test 0.8800 offers/res possibly helped by month-end interest. It didn't spend long up there though and we've been back down to test 0.8750 support/demand again.

EURGBP 15m

That up n down on EURGBP at first had GBPUSD running down to 1.3363 from 1.3425 only to reverse the move helped by a strong UK CBI retail sales report.

GBPUSD 15m

Elsewhere we've seen AUDUSD retreat further through decent support at 0.7850 to post 0.7836 before running into fresh demand while NZDUSD has also had a down n up session falling from 0.7215 to 0.7178 and currently 0.7208

USDCAD has been up to 1.2412 from 1.2360 on falling oil and back to 1.2380 as USD sellers return.

- Gold had a sharp dip into $1286 from $1292 and back up to $1294 only to fall back to $1288

- WTI down to $51.75 from $52.38

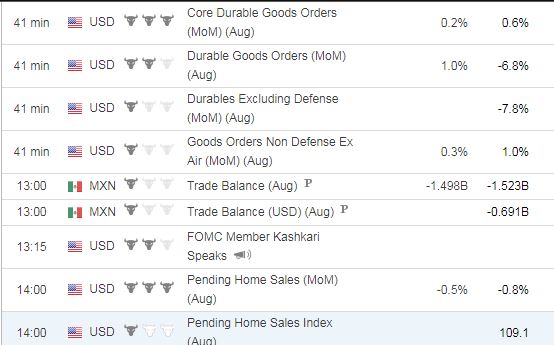

US durable goods at 12.30 GMT the key data risk to come along with pending home sales.