Forex news for NY trading on February 21, 2020

- Major indices close lower. Indices also lower for the week

- CFTC Commitments of traders: EUR shorts increase as the price moves lower

- US crude oil futures settle at $53.38

- BOEs Tenreyro: Economic impact of coronavirus may be large

- Germany Chancellor Merkel: Difference between EU leaders is too big on budget

- Fed's Clarida: He looks at asset prices but never in isolation

- Fed's Clarida and Mester to speak at the bottom of the hour

- Baker Hughes oil rig count 679 versus 678 last week

- The US CDC: Coronavirus is a tremendous public health threat

- European indices end the session lower but off lowest levels

- Saudi Arabia energy minister: WSJ story on cuts of output is "absurd and utter nonsense"

- New York Fed Nowcast rises to 2% from 1.4% this week

- China's Hubei province revises February 19 new cases to 775 from 349 previously

- Pres. Trump: If farmers need more money, you will get it

- WHO Tedros: We are concerned about an increase in cases in Shandong

- Feds Brainard: There is a risk inflation expectations have slipped

- Larry Kudlow on CNBC: Market mood swings don't reflect fundamentals

- US 30 year yield. The lowest level on record

- Existing home sales for the month of January 5.46M vs 5.44M estimate

- Markit PMI Manufacturing for February (P) 50.8 versus 51.5 estimate

- German finance minister Scholz: Economies benefit when trade flows freely

- Larry Kudlow: China needs US consumer goods

- Fed's Bostic on CNBC: Has no impulses to do anything with our current policy stance

- Canada retail sales for December 0.0% versus 0.1% estimate

- ECB Lane: Coronavirus uncertainty reigniting downside risk

- The GBP is the strongest while the NZD (and AUD) remain the weakest

The headline of the day is that the 30 year yield traded to a new all time low of 1.8843%. That took out the August 2019 low yield of 1.9039% and although the yield is closing above that old low, the closing level will be the lowest on record.

Helping the yields move lower is the:

- Expectation of a cut in US rates by July and potential for another cut later in the year

- Flight to safety flows

- Lower global growth from the coronavirus

- Dollar buying as the US remains a safe haven

- The Markit Service and Composite PMI data was below the 50.0 level while the manufacturing index was lower than expectations as well.

The 10 year yield also moved lower and approached the swing low from 2019 at 1.4272%. The low yield today reached 1.4359% before rebounding into the close to 1.4700%. The all time low yield was in 2016 at 1.3180% (see chart below).

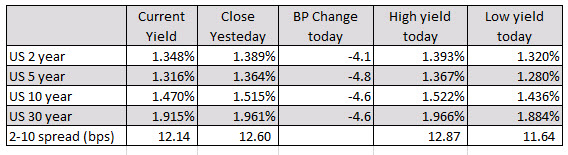

Below is a table of the current, high and low yields for the US debt along the yield curve. The 2-10 year spread also flattened to 12.14 basis points from 12.60 basis points yesterday.

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

Gold was another big mover today and this week. The price of gold is trading up $24.00 or 1.48% at $1643.43. The high for the day reached $1649.26. That was the highest level since February 2013. For the week, the price of gold settled last Friday at $1584. The current price at $1643.43 is a $59.43 gain for the week or 3.75% gain. Big breakout move for gold this week.

The fall in stocks, rise in gold, fall in yields led to a fall in the USD today. The USD was the weakest of the major currencies today. The strongest currency was the GBP (but it came off the highs in the NY session). The dollar fell by 0.61% vs the GBP. It also fell versus the EUR by -.59% vs the EUR and -0.58% vs the CHF.

For the week, the dollar fared better with the largest gains vs the JPY, AUD and NZD. The JPY was hit on the back of much weaker GDP growth and concerns about the coronavirus on future growth. The AUD traded to 11 year lows this week also on the back of concerns about the coronavirus. The NZD did not escape the decline as well.

The CHF was the strongest as it remains somewhat isolated and is also a safe haven currency in times of uncertainty.