FX news for trading on September 25, 2017.

- Nasdaq stocks tumble. Dow and S&P post modest declines

- Barclays trade of the week: Buy USD/CAD

- Lose your job to a robot? Forget joining the military

- Crude oil futures settle up 3.08% to $52.22

- The HSBC forex trader on trail for front-running isn't doing the industry an favors

- White House: We have not declared war on North Korea

- I'm starting to have some major doubts about corporate cyber-security

- Fed's Evans: I'm open-minded about hike at one of the next few meetings

- Can the GBPUSDs 200 hour MA hold?

- They won the White House but the Republican civil war continues on Tuesday

- Fed's Evans: Confident policy will still be accommodative even after taper

- Fed's Evans: The Fed needs clear signs of upward inflation before next rate hike

- Cable falls to 9-day low as the recent range breaks lower

- ECB's Coeure: We're not frightened about ending QE, we just want to be careful

- David Davis: We will honor financial commitments made during EU membership

- EU's Barnier: Brexit transition period will basically include no changes

- What's the trade if Kim Jong-Un tests a nuclear bomb over the Pacific

- Nasdaq getting hammered. Moves below 50 day MA.

- USD/JPY drops on fresh rhetoric from North Korea

- Bitcoin technicals: Draghi comment on bitcoin gives the price a push higher

- Spain says Catalonia may hold 'mock referendum' Sunday but it's not legal

- Draghi: ECB must be sensitive about not halting recovery

- Dallas Fed manufacturing index 21.3 vs +17.0 prior

- Ray Dalio on why you should own a bit of gold

- Draghi says it's not in the ECB's power to prohibit or regulate Bitcoin

- Draghi says downside risks to eurozone mostly political

- Draghi says governing council has not discussed changing 33% issuer limit

- Fed's Dudley Q&A: US economy in a pretty good place

- Draghi: The firm economic recovery still needs to translate more convincingly to inflation

- Chicago Fed national activity index -0.31 vs -0.25 expected

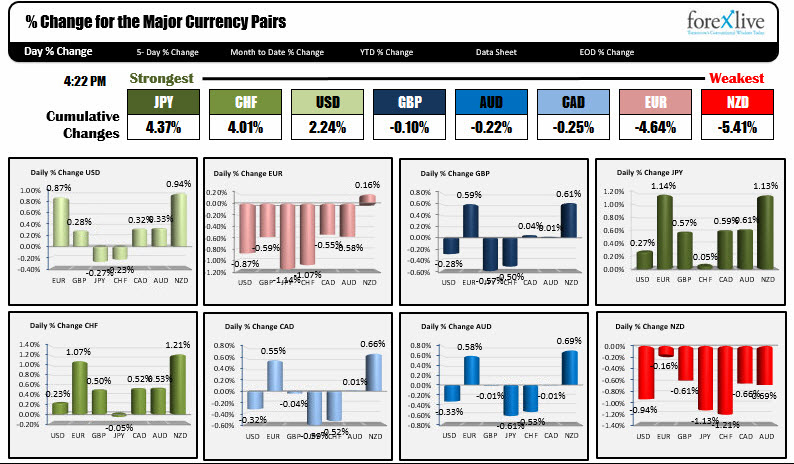

- The CAD is the strongest. The NZD is the weakest.

A snapshot of other markets near the close of day shows:

- Spot gold up $13.15 to $1310.16. The high reached $1312.36. The low reached $1289.354

- WTI crude oil is trading up 2.86% or $1.45 to $52.12

- US stocks were lower with tech and banks leading the way. S&P fell -0.22%. Nasdaq fell by -0.88% and the Dow fell by -0.24%.

- US yields were lower on flight to safety anxiety. 2 year 1.4230%, -0.8 bp. 5 year 1.8331%, -2.8 bp. 10 year 2.2163%, -3.3 bp. 30 year 2.758%, -2.1 bp.

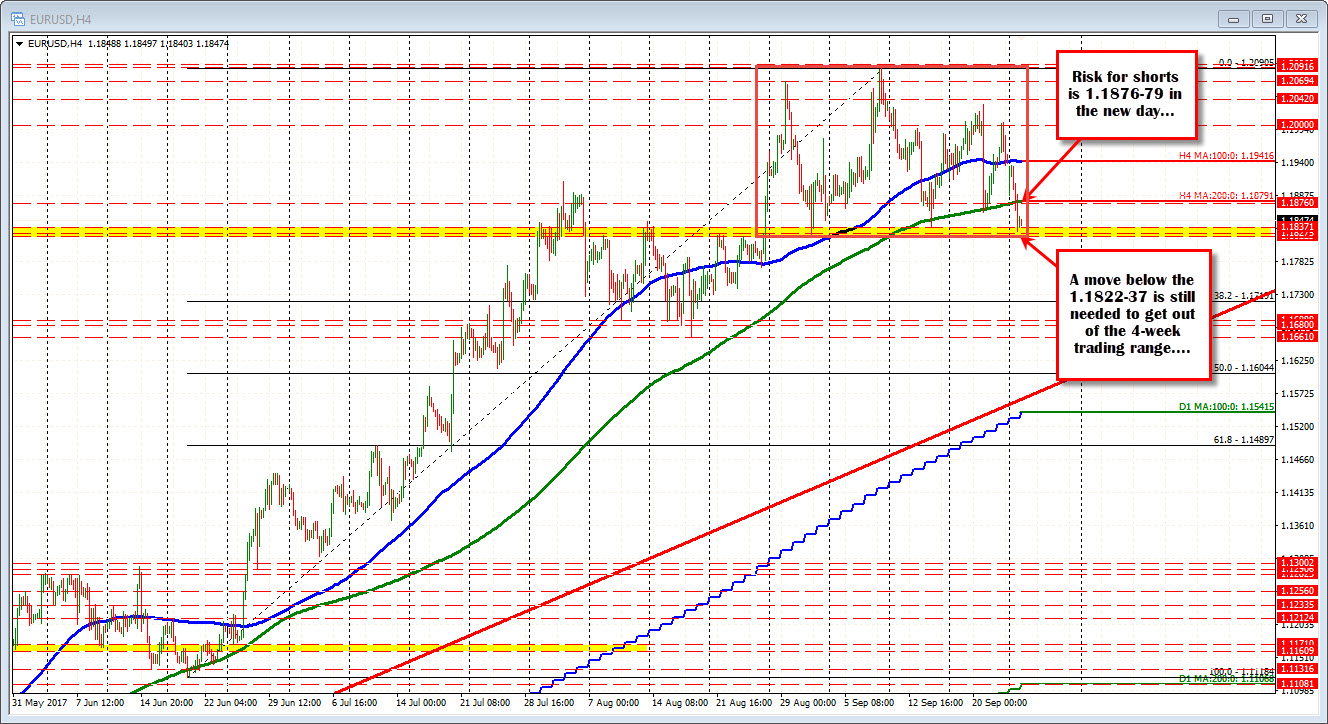

The US forex market was confined to a very quiet and narrow range for most of the morning. This despite ECB Draghi and Fed's Dudley speaking. Draghi spoke positively about the recovey but cautiously being to quick in taking away the punch bowl. Dudley was fairly upbeat. The EURUSD did not move much - trading above and below the 1.1876 level which I had earmarked as key technical level coming into the week (see video here). It was until there was comments out of a N. Korean official that the comments from Trump over the weekend were a declaration of war, that the markets started to get the wheels of change moving.

- Gold started it's run from down on the day to higher (closing up $13 on the day)

- Stocks which were under some pressure early, started to get weaker. The Nasdaq led the way.

- The JPY and CHF saw flows into their currencies. That sent all the JPY pairs lower

The table below shows that the JPY got stronger vs. the greenback by 0.27%, but the EURJPY saw a change of 1.14%.

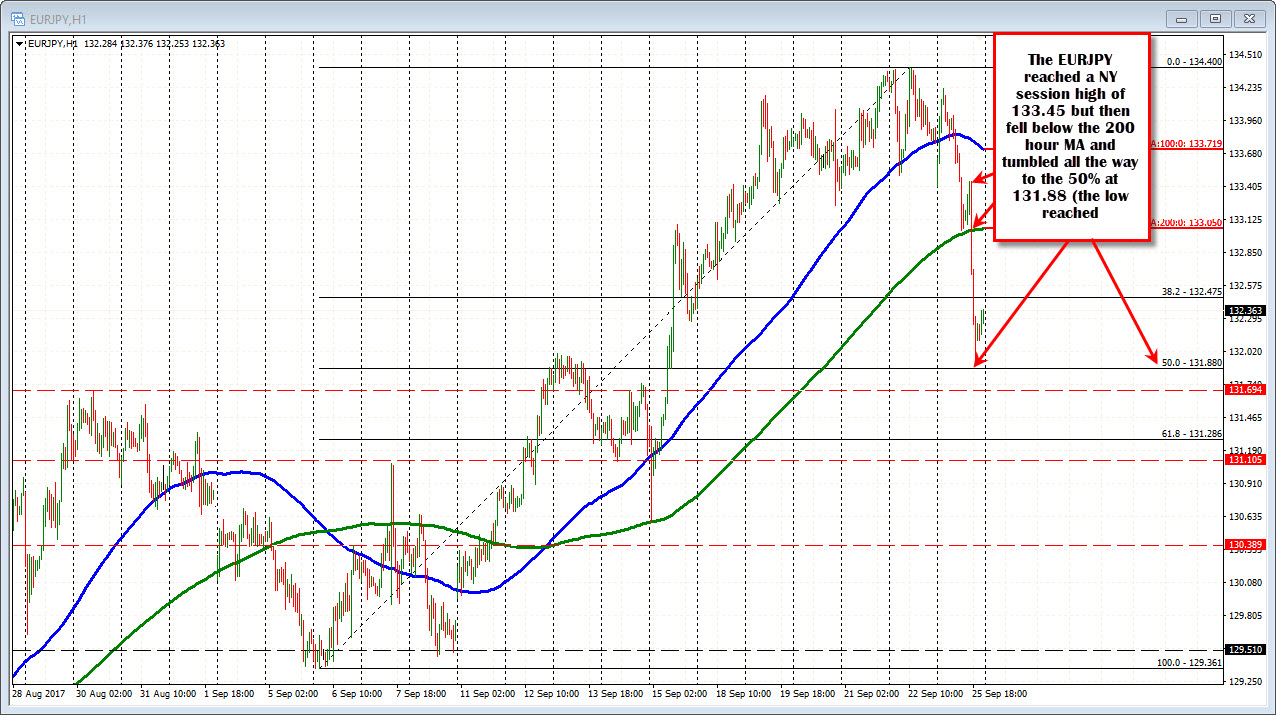

Looking at the EURJPY chart, the pair fell from a NY session high of 133,45 to a low just above the 50% of the move up form the September low at 131.88 (the low reached 131.90 before bouncing into the close. The bias tilted a little more negative but holding support at the midpoint give traders cause for pause on going all out bearish.

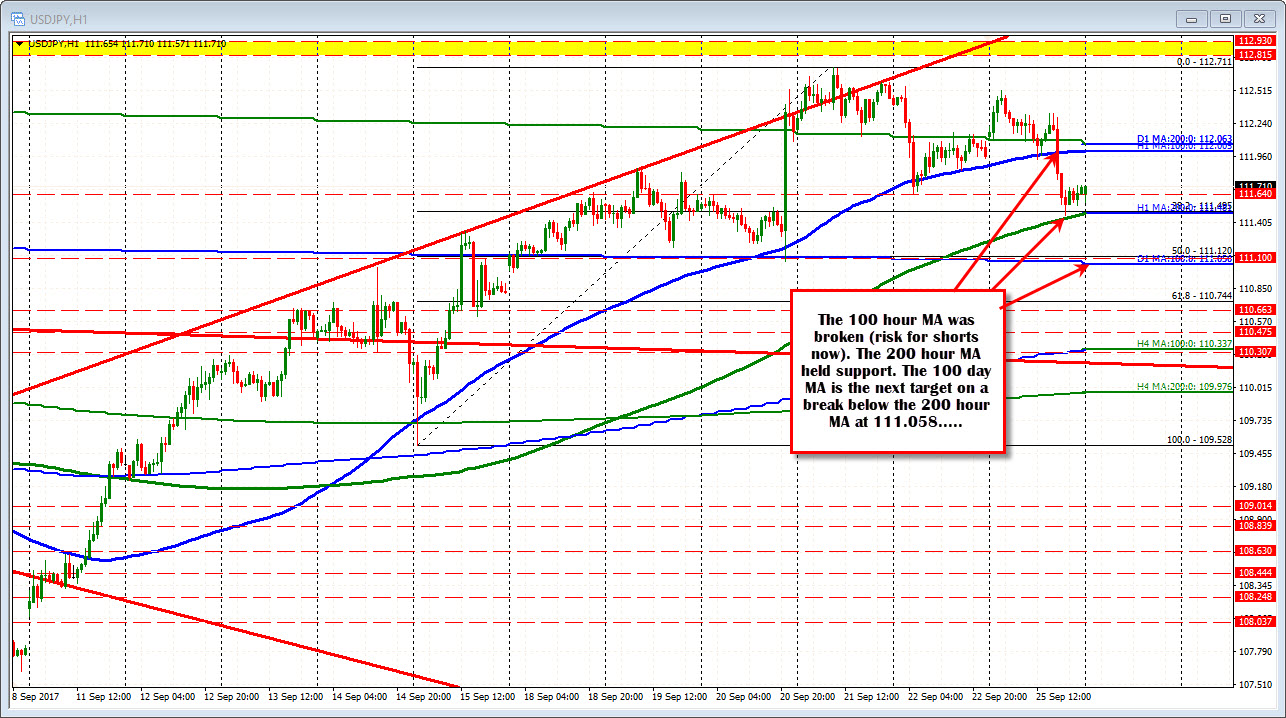

As mentioned, the USDJPY's fall was more contained but it did crack below it's 100 hour MA at 112.00 (currently). It''s fall took the pair to the next key MA - the 200 hour MA at 111.485. Support buyers leaned against that MA line and going into the new trading day, that MA will be eyed. So far, buyers are leaning against the level. However, on a break, look for the pair to make a play toward the 111.058-12 area whee the 50% of the move up from the September 15 low AND the 100 day MA are both found.

As mentioned above the EURUSD traded above and below the 1.1876-78 level for the first 3 -4 hours of trading in the NY session. The pair started to show more selling interest below the 1.1876 level as the EURJPYs tumble, helped to add some additional pressure to the technical fall. The pair fell to a low of 1.18308. That was between swing levels between 1.1822-37. The pair has moved higher into the close but if the fall away from the 1.1876 level is more bearish, that 1.1822-37 area will need to be broken.

The GBPUSD cracked below its 200 hour MA (currently at 1.3482). It was the first closes below that MA since the end of August . Stay below keeps the sellers in firm control. The 1.3400 is the next key target on the downside.