Forex news for New York trading on August 8, 2017:

- June JOLTS job openings 6163K vs 5700K expected

- Trump threatens "fire and fury" if North Korea escalates threat

- US sells 3-year notes at 1.520% vs 1.530% WI bid

- Gundlach: Betting on the VIX is free money

- South African President Jacob Zuma survives confidence vote

- Jamie Dimon: It's embarrassing to me that we can't get infrastructure built

- Magnitude 6.6 earthquake hits central China

- Redbook US retail sales +2.7% vs +2.8% y/y prior

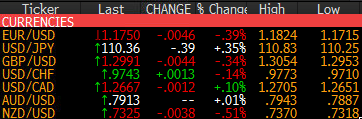

Markets:

- S&P 500 down 7 points to 2473

- WTI crude down 25-cents to $49.14

- US 10-year yields up 2 bps to 2.27%

- Gold flat at $1257

- JPY leads, NZD lags

It's not often that JOLTS is a genuine market mover but Tuesday was the perfect storm of an empty calendar and a big beat. The market didn't move hard but after a few minutes the US dollar bid gathered momentum in a resumption of the trend from Friday's non-farm payrolls report.

EUR/USD skidded to 1.1715 from 1.1810 over about two hours. Selling culminated into the London close and then the pair bounced to 1.1770 before settling at 1.1750.

Cable fought to hold 1.3000 before the data but gave way on the headlines and sunk to a two-week low of 1.2950. That psychological level held and the pair bounced to 1.2990 in a slow recovery into the start of Asian trade.

USD/JPY climbed to 110.75 from 110.35 on the data but a strong Treasury auction and risk aversion on the North Korea headlines helped to wipe out the move. Last at 1410.35.

USD/CAD edged above 1.27 for the second day in a row but Monday's high of 1.2714 held and that inspired some selling down to 1.2667.

NZD/USD wasn't so lucky as it sank 40 pips to 0.7325 on the JOLTS headlines and wasn't able to get off the floor.