Old teflon is in all sorts of trouble and is acting like an emerging market currency in the face of this dollar strength. Some of you might say that Europe is becoming an emerging market like nation given it’s troubles.

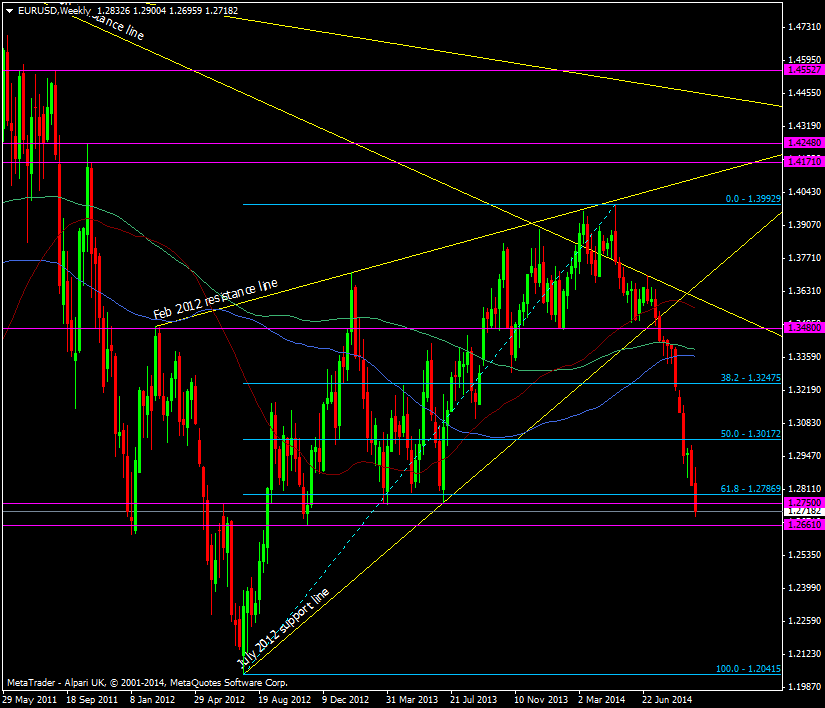

For what it’s probably worth (not much). There’s a last low to clear around 1.2660 before we can start thinking about seeing the low 1.20’s.

EUR/USD Weekly chart 25 09 2014

This has been one hell of a move down from near 1.40 and shows no signs of abating.It’s why we don’t fight the trend and if we do we keep it tight. I dangled a very small long ahead of the 1.2787 and 1.2750 levels with a stop at 1.2735 and that’s obviously smoked. Even as I put it on I felt it was wrong but went against my better judgement anyway to trade the tech. The big thing is that I made sure that the trade wouldn’t hurt me if it did lose.

So where do we go from here? There may be money to be made from a bounce here but we’ll need to see how the broken levels do on a test. 1.2735/40 is the first minor resistance point then 1.2750, then 1.2787. If you shorted the break then look to these levels to hold for the downside to continue. If they break then there may be a bout of short covering.

The trend won’t last forever but no one in Europe is going to come to your rescue as this is exactly what they want.

How euro bulls felt this morning