I posted earlier on a weekend article re market structure from Matt Levine, here:

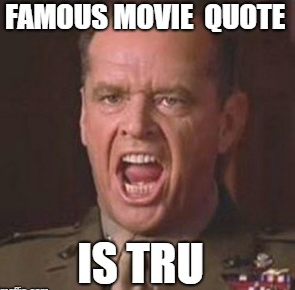

Ok, so now its time for rant number 2. This from the same article, more truth, if you can handle the truth

From Erik Schatzker interview with Cliff Asness

ES: The new market structure, with its high-frequency trading [HFT] companies, has reduced trading costs. But is it possible those companies won't supply liquidity when it's most needed?

CA: I don't actually believe this is true. Of course it could be true. There's an assumption that prior to HFT, old-school market makers used to buy something they knew would lose money because they had to make markets. No old-school market maker ever said, "Well, it's currently trading 20 percent below, but I'll pay you only 10 percent below because I've got to make this market more stable." It didn't happen. Liquidity has always run away in a crisis.

Levine:

If the market is crashing, and you call your dealer to try to sell your stocks, and she doesn't answer her phone because the last thing she needs right now is to buy stocks, you tend to think "oh well, who among us, I don't like answering the phone either, and I am sure she is busy providing liquidity to all the other people who are trying to sell."

But if the market is crashing, and you ping your electronic liquidity provider's computer to try to sell your stocks, and that computer has taken a look at the market, stuck out its little computer hand and unplugged itself, you get all mad about the illusory liquidity of high-frequency trading. Flighty robots!

LOL. Yep.

Key takeaway:

Liquidity has always run away in a crisis.

If you want a tattoo, get that on your forehead backwards and read it every day in the mirror.

;-)