Nikkei / Markit PMI data from Japan, this the preliminary indication

Joe Hayes, Economist at IHS Markit:

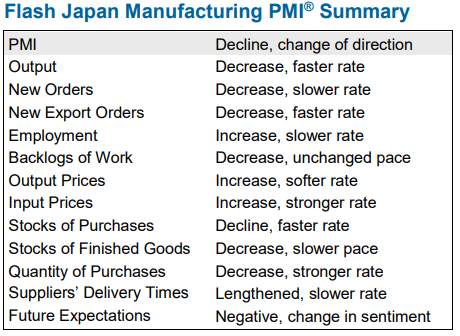

- "Following some tentative signs that the downturn in Japan's manufacturing sector had softened in April, flash data for May revealed these were short-lived, as output and export orders fell at stronger rates.

- The re-escalation of US-China trade frictions has heightened concern among Japanese goods producers. Underlying growth weakness across much of Asia led to struggling exports, which fell at the sharpest rate in four months. Difficulties on the international front merely add to uncertainties domestically, with upcoming upper house elections in July, and the impending sales tax hike later this year. Subsequently, sentiment turned negative in May for the first time in six-and-a-half years."

I posted earlier on the FOMC minutes, notes via analysts, with the FOMC viewing the inflation dip as transitory. As the trade wars accelerate higher frequency data, like this, show up the impact.

The transitory argument may look a bit shaky.