I posted earlier the JP Morgan fundamentals view for euro, here: Euro – JP Morgan – Key Currency Views – Key drivers of negative view on EUR/USD

Here is their technical analysis, from the same client note.

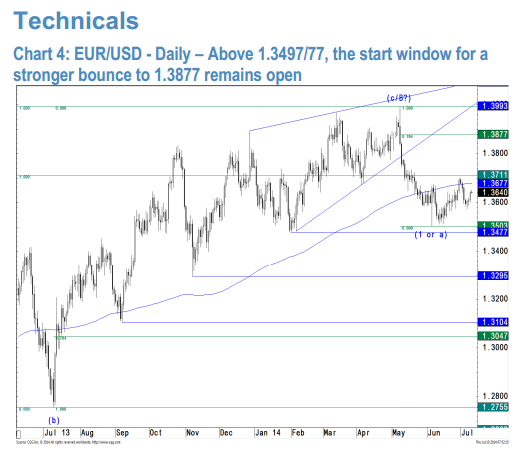

- Given the fairly impulsive structure of the decline from 1.3993 to 1.3503 we see a high likelihood that the broader up-trend has been reversed.

- The final certainty for this view would however only be given on a break below 1.3497/77 (weekly trend/2014 low), which means the market has kept a backdoor open to potentially still extend it into the next major resistance zone between 1.4196 (monthly Ichimoku-lagging) and 1.4259/83 (int. 76.4 %/pivot).

- Only a break above weekly trend line resistance at 1.4500 would constitute another scale jump in favor of another extension to massive resistance between 1.4944 (2011 high) and 1.5057/1.5147 (76.4 %/2009 high).

- A break below 1.3477 would on the other hand rip the downside wide open for a straight extension towards 1.3295 (pivot) and the next major support zone between 1.3104 and 1.3047 (pivot/int. 76.4 %) which look like interim targets only within a new, long-term downtrend.

- In the short-run we are looking for a range breakout between 1.3557 and 1.3671 (minor 76.4 % retracements) as such breaks would deliver an early indication whether 1.3477 (2014 low) or 1.3877 (int. 76.4 % on higher scale) will be tested next. These are the boundaries of the outer range and would have much stronger implications once taken out.

- Given the impulsive nature of the first initial decline from 1.3993 to 1.3503 though, we see a high probability that the market will fail to break decisively above 1.3877. If so we’d conclusively expect a straight test and most likely break below 1.3477 which would ultimately target 1.2897 (weekly trend) and 1.2502 (76.4 5 on big scale).